Economist refutes “giveaway” myth

An in-depth study by a highlyrespected University of Alaska economist has concluded that the recently-enacted oil production tax reform law has little to do with lower revenues and larger budget defi cits the state is anticipating. Rather, the revenue reductions and budget deficits are mainly due to declining oil prices, falling production, and higher costs, said Dr. Scott Goldsmith.

Speaking at a Resource Development Council breakfast meeting in Anchorage last month, Goldsmith said that at current oil prices and costs, the new tax regime, known as the More Alaska Production Act (MAPA), and the former that preceded it, ACES, bring in about the same amount of revenue.

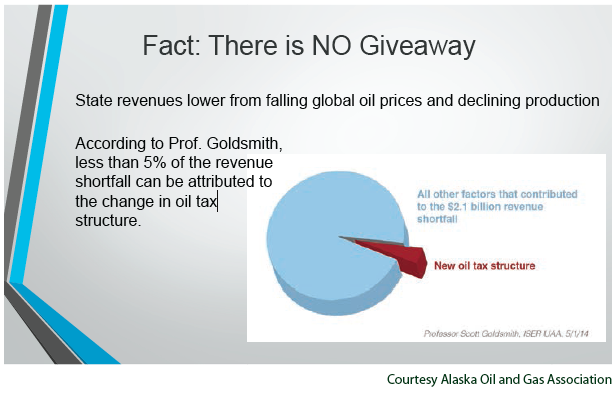

Opponents of MAPA have mislabeled it as a $2 billion “giveaway.”

Goldsmith said there is no giveaway. The giveaway figure was the difference between the $7.2 billion the Alaska Department of Revenue (DOR) had forecasted in oil revenues for fiscal year 2014 back in 2012 and DOR’s fall 2013 forecast of $5.1 billion. Opponents of the new oil production tax blame the difference on the tax change.

Goldsmith compared that to concluding the crowing of a rooster in the morning causes the sun to rise. His study found only four percent of the amount in FY 14, $88 million, was due to the change in tax regimes. He said 96 percent was due to other complex forces, including price and production forecasts and costs.

Goldsmith’s analysis demonstrated that even without enhanced production, tax revenues could be higher under MAPA than ACES if recent price and cost trends continue, which experts agree is likely. Furthermore, Goldsmith’s modeling showed that under reasonable range of assumptions, a modest increase in oil investment would create more state revenues under MAPA than ACES.

While Alaska collected a windfall during the early years of ACES, Goldsmith’s report indicates it would be a mistake to assume current conditions would allow a return to those days. Goldsmith’s analysis explains that today’s market conditions of rapidly increasing costs, a sharp decline in production, and lower oil prices have significantly changed the tax consequences of ACES.

With regard to costs, Goldsmith explained that production expenses have risen sharply, more than doubling in the past decade, and are expected to climb further. He noted a big cost at Prudhoe Bay is water handling. In fact, North America’s largest oil field is now producing more water than oil. Goldsmith said Prudhoe Bay is now a giant water field with oil as a by-product, generating four times more water than oil.

Manpower costs have also risen, tripling since 2005. These costs and others are spread across fewer barrels of oil being produced. In 1980, the average North Slope well produced 3,500 barrels per day compared to about 250 barrels per day in 2014. Higher costs and lower production drives up the cost of production per barrel, affecting the net value of the oil against which production taxes are levied.

Goldsmith also acknowledged why some would question an oil company’s rationale of embracing a new tax regime that could potentially result in a higher tax bill. The senior economist said MAPA can be modeled more efficiently and is more predictable in planning for long-range investments. He explained that required monthly calculation and substantial fluctuation in tax liabilities contributed to an unstable and unpredictable fiscal climate under ACES. Moreover, with the extreme progressivity of ACES at high oil prices, companies captured very little of the upside value to offset the investment risk taken to increase production.

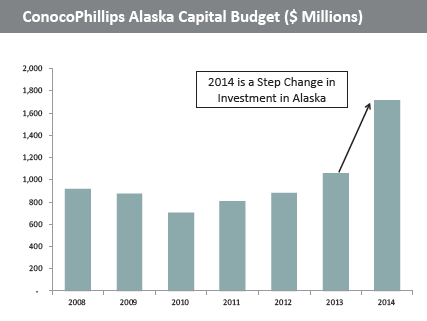

Goldsmith said that with new investment coming into Alaska’s oil patch, thousands of new long-lasting jobs would be generated, resulting in enhanced consumer purchasing power benefitting the entire economy. He noted that each industry job generates a lot of other jobs across the state. Goldsmith found that $4 billion in new industry investment would result in 5,000 new public and private sector jobs per year in the state over 20 years, with more than $300 million annually in additional wages and salaries.

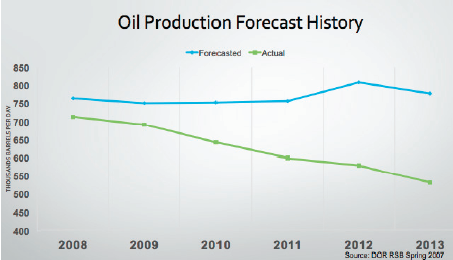

Goldsmith’s study attracted much attention statewide, given the hotly contested referendum on Alaska’s primary election ballot in August to repeal MAPA. Those supporting MAPA and opposing the referendum say oil production tax reform was needed to encourage production-generating investments and stem declining North Slope oil production, which accelerated under ACES.

Since the Legislature approved the tax change in 2013, industry activity on the North Slope has surged, $4 billion in new investments have been announced, thousands of barrels of new oil is coming online, and hundreds of new jobs have been created. In addition, projects that have sat on the shelf for years are now being re-evaluated and could be sanctioned this fall. Oil production is now expected to decline only two percent this year and could be trimmed to one percent in 2015, after declining eight percent last year.

Following Goldsmith’s presentation to RDC, former Governor Tony Knowles said Alaska’s future would best be served by closely monitoring the effect of new investments on production and tax revenues. “SB 21 (MAPA) has been in effect for four months, and we need to give it a chance to work,” Knowles said. “There will be ample opportunity to make needed changes if the companies’ commitments do not generate more production. The referendum is not about the oil companies it is about Alaska’s economic future. Now that we have the facts, I’m voting no on Ballot Measure One.”

"I’m voting no on Ballot Measure One.” - Tony Knowles

Goldsmith’s study is on UAA’s Institute of Social and Economic Research website as Web Note No. 17, “Alaska’s Oil and Gas Production tax: Comparing the Old and the New.” His presentation to RDC is also available at akrdc.org.

The study was funded by a grant from Northrim Bank, which has supported a broad range of ISER economic studies over the past 20 years focusing on issues important to Alaska’s economy.

Scott Goldsmith

Return to newsletter headlines