Oil tax reform: Why should Alaskans care?

It’s about attracting investment to boost production

After years of study and careful analysis, the Alaska Legislature in April 2013 passed Senate Bill 21, the More Alaska Production Act (MAPA). The reasoning behind this law, which reformed oil production taxes, is simple – create a business-friendly tax structure that will compel oil companies to fund high-cost Alaska projects, ultimately resulting in more oil production on the North Slope and increased revenue to the state.

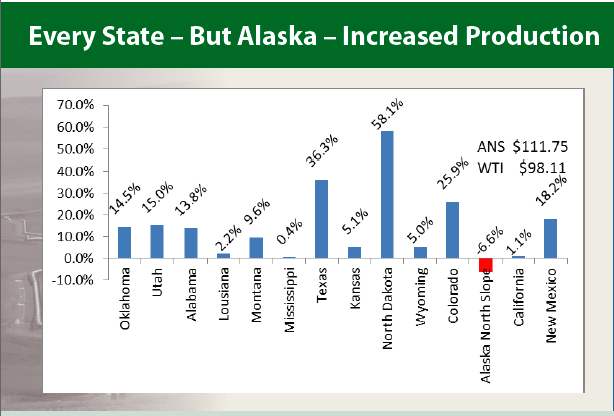

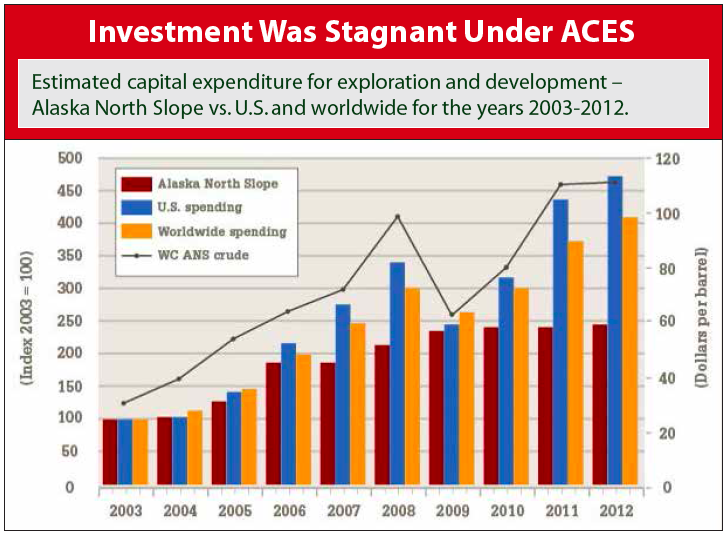

The big challenge facing the state is that Alaska projects must compete against other opportunities in a company’s global portfolio. Those projects with the higher return on investment are the ones that get funded. A 400% tax increase in oil production taxes over the past decade put Alaska at a disadvantage when it came to increased capital spending for production-adding investments. As a result, Alaska production has steadily declined and investment has been relatively stagnant here since 2008, while sharply increasing elsewhere.

Taxes do matter, especially in Alaska where costs are among the highest in the world due to challenging Arctic conditions and the remoteness of our oil fields.

Why should you care?

- If the oil industry expands and prospers, so does Alaska’s economy. A healthy oil industry is essential for a healthy Alaska.

- Oil tax reform increases the likelihood of more production-generating investments moving ahead.

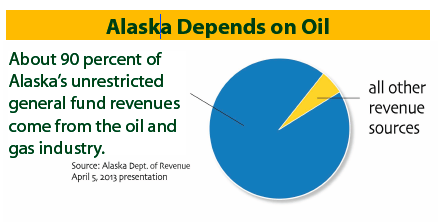

- Not only does the oil industry provide for 90% of Alaska’s unrestricted general fund revenue, it accounts for one-third of Alaska jobs.

- Increased investment and production will lead to more jobs. For each new job in the industry, nine more are created across the state’s economy.

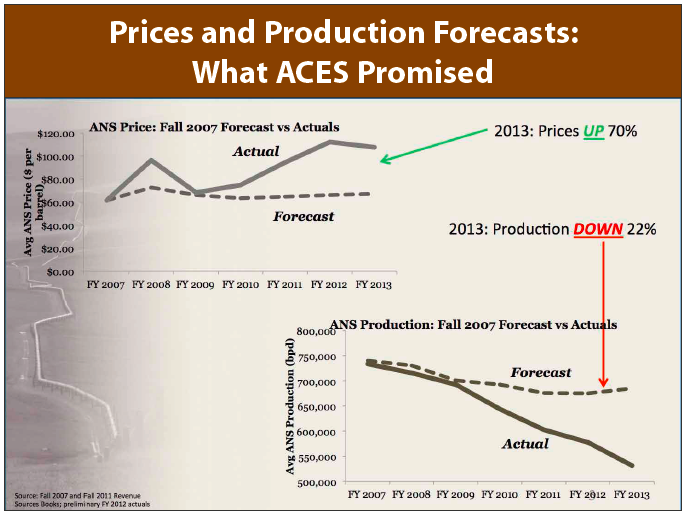

- Despite record high oil prices in recent years, North Slope oil production fell more than 200,000 barrels per day under ACES, the former tax regime.

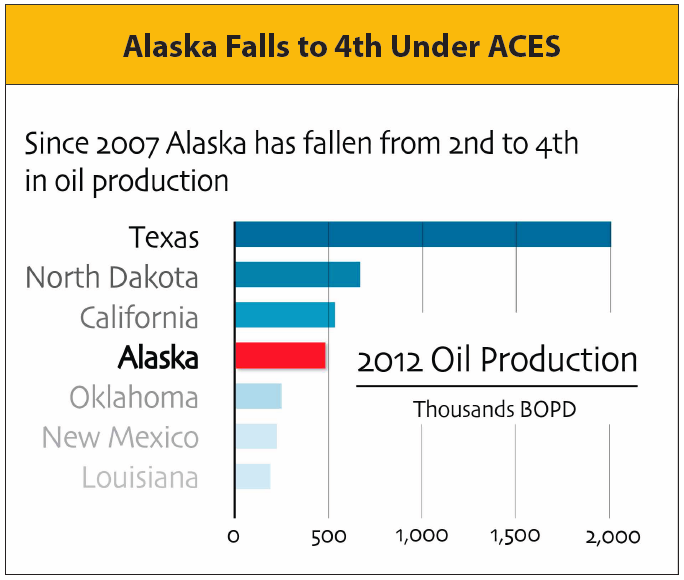

- Alaska was the only one of 13 oil-producing states where production declined in 2011 and 2012. All others increased, including California, which recently surpassed Alaska in production, leaving our state in fourth place.

- Reform of Alaska’s oil tax system is rejuvenating the oil industry here. It has sent an important signal that the state is open for business as it pursues a long awaited $65 billion Alaska LNG project.

- Development of the North Slope’s immense natural gas deposits for Alaskans and markets abroad is dependent on a healthy and robust oil industry in Alaska.

The new tax system is a game-changer

- The new law is already encouraging more investment on the North Slope, resulting in new jobs, more oil production, and increased economic activity across the state. In fact, $4.5 billion in new projects are now moving forward and billions of dollars in additional projects are under evaluation – and that is just a start.

- For 2014, ConocoPhillips is budgeting $1.7 billion, that’s twice what it spent in 2012. BP is also moving aggressively on new production, reinvesting 90 cents of every dollar it makes here over the next five years in Alaska.

- New exploration and development by newcomer Repsol and Brooks Range Petroleum will move forward this winter. Both companies report the new tax law played a big role in their decisions.

- Overall, the state now predicts an additional $10 billion in new North Slope investments beyond what was anticipated last year.

- Approximately 70 percent of the major producers capital investment on the North Slope in recent years was targeted at maintenance. Under MAPA, a production tax credit is now allowed to encourage new production, which must come before the tax credits are paid.

The new law is not a giveaway

Critics of the More Alaska Production Act claim it is a giveaway with nothing in return. The facts do not support such claims.

- The “giveaway” argument assumes no new investment or production, which defies reality.

- Since SB 21 passed last April, production-generating investment has increased sharply and so has economic activity. The industry is responding - just as it should - to a more friendly business climate.

- North Slope production declined 8% last year, but new investment is expected to slow the decline to only 2% in 2015 and 2016. Returning to a broken tax system like ACES guarantees accelerated production decline and lost investment to competing oil and gas provinces.

- Under the former tax, the total government “take” was over 70% last year. The new tax law reduces the take to just over 60%, certainly not a giveaway and in line with many other oil and gas provinces. (See charts below).

- The real giveaway was the potential investment and oil production lost under ACES. Oil tax reform is a game changer that gives us back the opportunity to attract the investment needed to secure new production and more revenue to the state and the Permanent Fund.

Greater protection for Alaska at lower oil prices

- The new law raises the base tax rate from 25% to 35%, but eliminates the crippling progressivity feature in ACES that results in a marginal tax rate as high as 90% at elevated oil prices, leaving the industry with virtually no upside.

- No matter how far oil prices fall, the new tax rate will remain at 35%, giving the state more protection at lower oil prices.

- The progressivity formula in ACES ramped tax rates up quickly as oil prices climbed, but likewise dropped them as prices fell, as they have recently.

Truth: The state’s growing budget deficit is NOT due to oil tax reform

The current state deficit is NOT due to oil tax reform. The larger than anticipated revenue decline is mostly a function of lower than expected oil prices, lower than projected oil production, and higher expenditures.* Production under ACES declined much faster than anyone predicted, 8% alone in 2013.

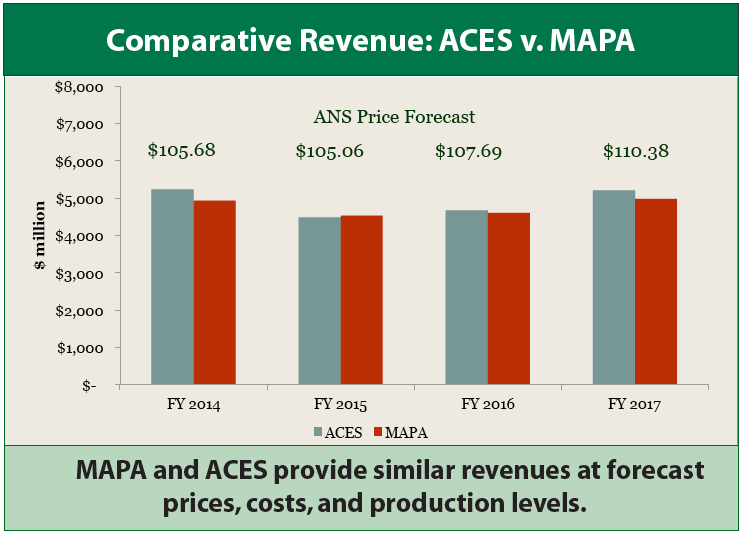

- State data shows $250 million in lower revenue in FY 14 from tax reform, not $2 billion.

- All of the projected $2 billion revenue drop estimated for FY 15 would have occurred even if ACES had been left in place.

- In FY 15, the state is expecting to take in more revenue under the new tax system than ACES.

- At current oil prices of approximately $105 a barrel, the two tax systems are essentially revenue neutral – a wash between what ACES would have generated in revenue to the state and what the new tax will earn, but under MAPA we see more production-adding investment.

- If oil prices continue to fall as the federal Energy Information Administration is forecasting, the More Alaska Production Act will result in more revenue to state coffers than ACES. Under the new law, oil producers will pay a higher tax at lower oil prices than they would have under ACES, 35% versus 34.9% this fiscal year and 35% versus 32.6% in FY 15.

- The most recent revenue forecast is conservative and does not include production from new projects or those now under evaluation.

*In its spring 2013 forecast, the state estimated North Slope production at 526,000 bpd for FY 14, but the updated forecast in December showed a projected decline of 18,400 bpd to only 508,200 bpd for FY 14 and 498,400 bpd in FY 15. The spring 2013 forecast for the price of North Slope crude was $109.61 for FY 14. The December forecast is now projecting $105.68 per barrel in FY 14.

The new tax system is working

Alaska’s economy depends on a healthy and growing oil industry. The good news is the new oil tax system is doing what it’s suppose to do – spurring new investment to increase oil production and generate more public revenues than ACES would have in this lower oil-price environment. We are already seeing increased activity and hundreds of new jobs as Alaska businesses position themselves to work under a much improved business climate created by tax reform.

Oil companies have many investment opportunities outside Alaska, but the new tax system has allowed the state to better compete for the capital needed to advance Alaska projects and stem the decline in North Slope oil production.0

With its overreaching tax policies, the old tax system (ACES) has a proven track record of failure to draw production-adding investment. A return to ACES would guarantee accelerated production decline, which over the long term means less revenue to the state, making it tougher to fund education and public services.

What we need is a growing economy, which creates a bigger economic pie that creates jobs and opportunities for all Alaskans.

When Alaskans go to the polls in the August primary election, they will consider a repeal of the More Alaska Production Act and a return to ACES (Ballot Measure 1).

We are at a crossroads. We must take the right path for the long term. Let’s keep growing the pie for all Alaskans. We must vote no on 1!

Return to newsletter headlines