Oil tax reform is working - let's give it a chance

RDC board members from across Alaska’s resource industries – oil and gas, mining, forestry, fishing, and tourism – urge Alaskans to Vote No on 1 in the primary election on Tuesday, August 19. Oil tax reform is working and we must give it more time to do what it was designed to do – put more oil in the pipeline and generate more state revenue.To view the entire RDC board, visit akrdc.org/membership/. (Photo by Judy Patrick)

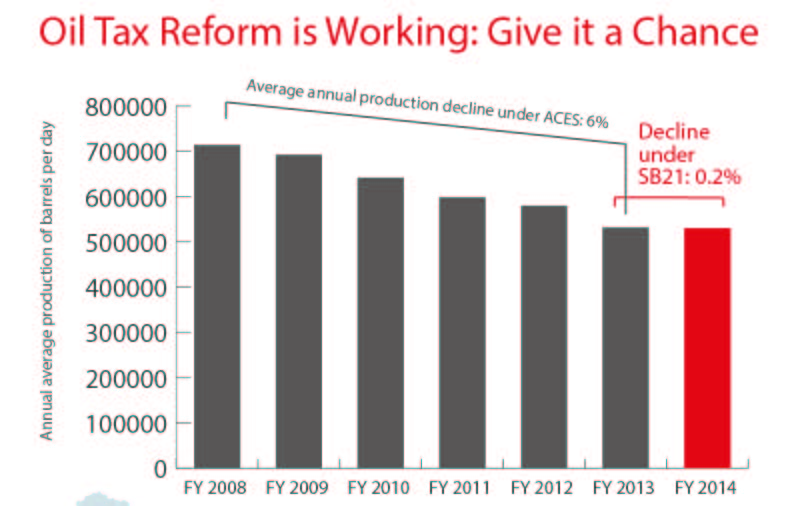

Producers erase production decline

Oil tax reform and the resulting boom in North Slope production activity is paying off.

For the first time in more than a decade, North Slope producers have nearly erased a long-term decline in oil production. An intense focus on “workovers” of producing wells to stimulate production and the drilling of new producing wells have cut the decline in North Slope production to a mere 0.13 percent in fiscal year 2014.

As recently as December, the state estimated a 4.4 percent decline for this year.

The estimated daily average for fiscal year 2014, which ended June 30, is 530,939 barrels per day compared with the average of 531,639 barrels per day in FY 2013, which saw an 8.2 percent decline in production from the year prior.

The fractional decline in FY 2014 is the second-best annual performance since 1989. FY 2002 saw a 2.6 percent increase when two new fields – Alpine and North Star – began producing. The long-term average decline since production peaked in 1988 at two million barrels per day is six percent.

Proponents of Ballot Measure 1, which would repeal oil production tax reform, note that while the industry has been successful in curbing declining production in the short term, the state is forecasting a sharp decline in production over the next decade.

However, the state’s long-term production forecast, published last fall, does not reflect billions of dollars in new producing-adding investments that have been announced since the passage of oil tax reform last year.

“The number one statistic that matters most to Alaskans is production, not forecasts or projections,” said Kara Moriarty, President and CEO of the Alaska Oil and Gas Association. “The news that we have stopped the drop in our oil production for the first time in more than 10 years is no surprise to those of us who believe creating a competitive investment climate will bring more rigs, more jobs, and more oil to the state,” Moriarty added.

“Proof of this concept is now out for everyone to see: oil tax reform is working,” Moriarty explained. “More production also means more royalties going into the Permanent Fund, as a result of the change. It’s also another compelling reason to vote no on ballot measure 1 on August 19.”

Since SB 21 (oil production tax reform) passed the legislature last year, oil companies have announced nearly $10 billion in new investments that could add more than 100,000 barrels per day in new production over the next eight years. This is in addition to $5 billion in new projects underway at Point Thomson and in the National Petroleum Reserve-Alaska.

ConocoPhillips has three new projects in the works that will result in a net addition of 40,000 barrels per day in new production by 2017. BP also has new projects that will add 40,000 barrels per day in new production.

ConocoPhillips is budgeting twice what it spent in Alaska in 2012 and BP is reinvesting 90 cents of every dollar made in Alaska.

While it takes years for major projects to come on line, BP and ConocoPhillips have added four drilling rigs to their operations. A record number of rigs are now at work on the North Slope.

Despite the lack of a specific guarantee in the law, there have been major investments and achievements since SB 21 was approved.

Return to newsletter headlines