What if I were to tell you that BP is adding drilling rigs on the North Slope?

I’m sure that people who’ve supported ACES and said high taxes don’t matter when it comes to investment would say, “We told you so.”

I’m also guessing that most Alaskans would say it’s good news: more rigs must mean more production, more jobs, more business activity.

But it’s only good news if you take a short-term view of Alaska’s future – one that has a 10 or 15-year horizon, not 50 or longer.

These rigs will be deployed in legacy fields like Prudhoe Bay to accelerate production from existing reserves. They won’t search for or produce new oil. They’ll drain the easiest oil faster in order to offset decline and add cash flow in the near term – they’re a short-term solution to a short-term state fiscal policy.

ACES has delivered predictable results: tens of billions of dollars in state government revenues at the expense of long-term production, investments, jobs, and a sustainable base for Alaska’s economy.

Since ACES was imposed in 2007, North Slope oil production has fallen by more than 200,000 barrels a day, and production continues to decline an average of 6-8 percent each year.

Today, TAPS operates at less than one-quarter of the volume it once carried. As production declines, operational risks rise as flow rate and temperature continue to drop.

Since ACES was enacted, investment in new production has fallen off. Last year, only $1 out of every $4 in our capital expenditures went toward enhancing production in BP-operated fields. The remainder was spent on operations, maintenance and repairs.

Apart from Point Thomson, which has unique circumstances due to the settlement with the state, we haven’t sanctioned a single large project on state acreage.

Nonetheless, we’ve continued to invest in preliminary work to develop challenged resources like heavy and viscous oil and the Sag formation in the hope that fiscal policy would change. But hope is not a successful business strategy.

Historically, we’ve focused both on producing existing reserves and developing new ones. Since ACES, riskier long-term investments have been out of sync with state policy. We can no longer justify investing in “what if;” our plans must conform to “what is.” Our focus now is on accelerating production of existing reserves, not developing new ones.

Some of the changes we’re forced to make today paint a bleak picture of Alaska’s future: reduced investment in new oil reserves like heavy and viscous oil, which comprise more than half of the known resources in legacy fields…faster depletion of existing reserves…fewer jobs…continued decline…limited application of new technology.

This picture of Alaska’s future doesn’t have to become a reality.

With the new legislative session, the State over the next several months can implement meaningful change that will benefit everyone.

Alaska is still a great resource state…one that’s very important to BP. We haven’t given up on our vision of a long-term future here.

Tax reform won’t transform potential into projects and new production overnight. But it will enable us to immediately refocus on building a long-term future, finding ways to unlock the potential of billions of barrels of new oil and tens of trillions of cubic feet of natural gas and charting a course to thrive here for the next 50 years rather than shrinking our activities to survive the next 15.

Alaska can keep the current policy that limits investment or change it to something that attracts investments while securing a long-term future for Alaskans. It’s a choice between “going out of business” and “open for business.”

Just as we’re currently forced to adapt our plans to a policy that discourages investment, BP will respond with new investments if a change in policy gives us a chance.

It hasn’t been that long since increased drilling on the North Slope was good news for Alaska’s future. With a new long-term vision of Alaska’s potential, it can be again soon.

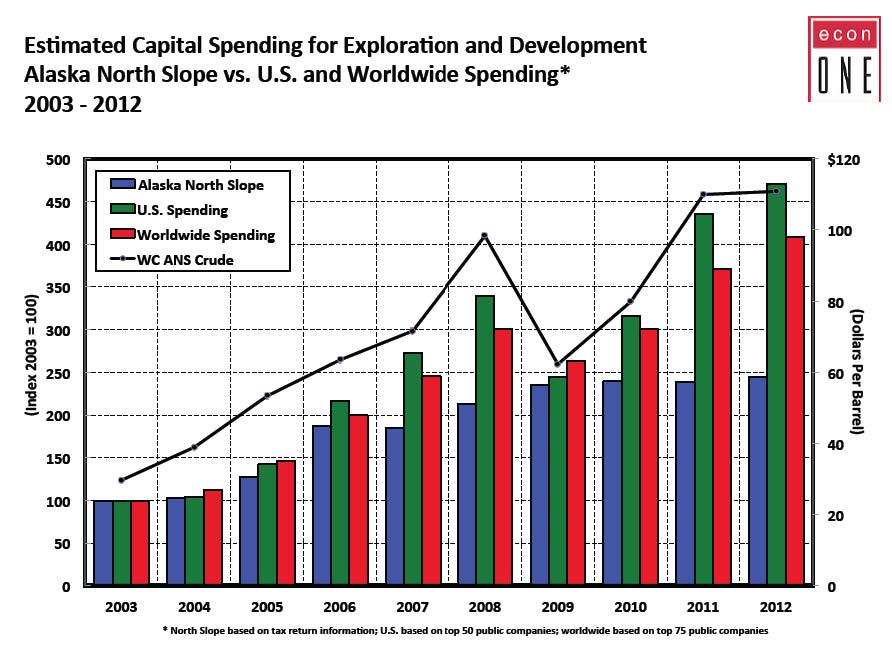

Table shows capital spending in Alaska remains flat while spiking elsewhere.

Editor’s Note: This column is a condensed version of Phil Cochrane’s speech at the Alaska Support Industry Alliance annual conference in Anchorage last month. His full presentation is available at alaskaalliance.com, under events/presentations.

Return to newsletter headlines