Alaskans support oil tax reform

Alaskans came out in force at the first public hearing of Governor Sean Parnell’s bill to reform the production tax on North Slope oil.

Representatives from organized labor, mining, timber, and other sectors urged legislators to make changes to the oil tax structure this session in order to attract new investment and increase North Slope production.

John Sturgeon, President of Koncor Forest Products, pointed out that the timber industry was once Alaska’s second largest but it has nearly vanished – largely because of adverse public policies. He urged lawmakers to make sure that doesn’t happen to the oil industry.

Aves Thompson, Executive Director of the Alaska Trucking Association, told legislators that while he was not a tax expert, “I know something needs to be fixed.”

More production is the key to a stronger economy, said Jeanine St. John, Vice President of Lynden Logistics. “The decline in North Slope production is truly attributed to our tax regime.”

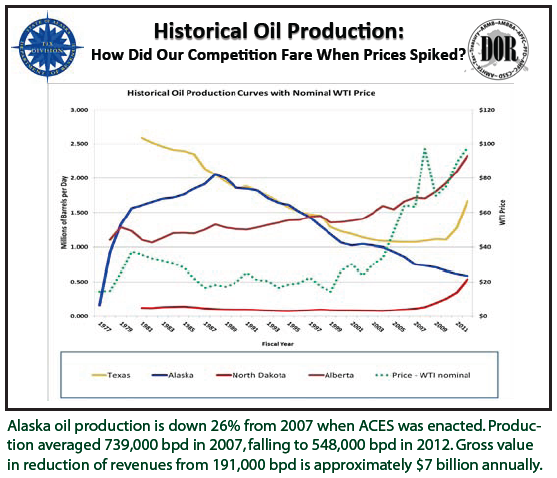

If Alaska would offer more competitive tax rates, it would see increased activity and production on the North Slope, similar to what North Dakota has experienced, said Scott Thorson, President of Network Business Systems. He recently expanded his Anchorage-based technology services firm to North Dakota. “We’re nervous about Alaska’s economy, watching production decline.”

Cruz Construction also expanded to North Dakota after its operations experienced a sudden downdraft in North Slope business. Dave Cruz, the company’s president, expressed frustration with roadblocks to exploration and production in Alaska, pointing out that it takes only a few months for a company to begin producing oil in North Dakota after beginning work, whereas it takes much longer in Alaska.

“A healthy oil industry is good for a healthy mining industry,” said Deantha Crockett, Executive Director of the Alaska Miners Association. She said Alaska’s oil production tax structure is discouraging investment here.

Steve Pratt, Executive Director of Consumer Energy Alliance Alaska, urged legislators to support an atmosphere that compels industry to invest in new Alaska production. “What would an additional $50 million to $100 million in daily economic activity – 500,000 to 1,000,000 barrels per day – do for the state? For the nation? We need to stop exporting energy dollars and start importing energy jobs,” Pratt said.

Native corporations also supported oil production tax reform. Ethan Schutt, Senior Vice President for Lands and Energy Development, urged lawmakers to focus on restoring Alaska’s competitive position. “Private capital goes to places where it is welcomed and rewarded,” Schutt said.

Speaking about the power of partnerships, Joe Mathis, Vice President of External Affairs at NANA Development Corporation, quoted Winston Churchhill, “If we are together, nothing is impossible. If we are divided, all will fail.”

“Without a stable, robust oil and gas industry, our organizations and the benefits we provide to our people will not be sustainable,” warned Tara Sweeney, Senior Vice President of External Affairs for Arctic Slope Regional Corporation. “We support a healthy industry that promotes responsible exploration, and incentives to spur additional investment in legacy fields.”

Grant Johnston, Vice President of MSI Communications, said “the problem is simple, Alaska lost its competitive edge.” Barbara Huff Tuckness of Teamsters Local 959 said the governor’s bill was a good start.

Compared to current law, Parnell said his new oil production tax legislation better protects Alaskans at lower oil prices, and reduces the risk to the state treasury by restructuring the credit system. He said it simplifies the tax system by eliminating the monthly progressivity tax, restructuring tax credits, and maintaining the flat, base tax rate of 25 percent. It also includes a 20 percent gross revenue exclusion for new oil. Parnell said the legislation encourages new production by focusing incentives on production.

The legislation, SB 21 and HB 72, eliminates the qualified capital expenditure credits for North Slope costs, including maintenance, and reforms remaining credits so that they are taken when there is production. The State’s exploration incentives, which can cover up to 40 percent or more of exploration costs, will remain in place.

“Alaska faces the stark reality of a steady six percent decline, with the flow now standing at less than 560,000 barrels per day,” Parnell pointed out. “The decline is not because Alaska is running out of oil, it is because we are running behind the competition.”

High oil prices have sharply expanded industry investment in oil exploration and production, but not in Alaska, which has dropped behind North Dakota in production and is at risk of falling behind California. Alaska now accounts for eight percent of domestic production, falling from a high of 25 percent in the late 1980s.

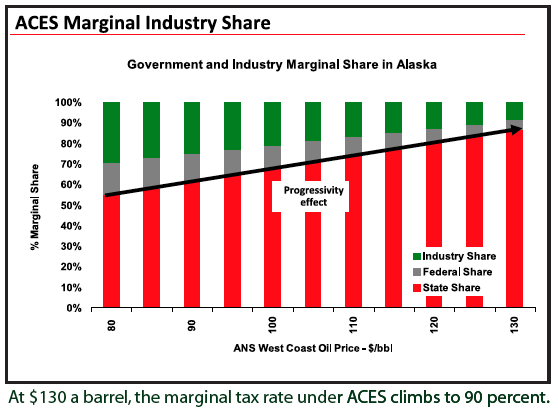

The current progressive tax rate structure creates highly variable tax rates, and severely limits the upside for investors at high oil prices, making other areas in the Lower 48 a more attractive place to invest.

This is troublesome since much of the oil forecasted to be flowing through TAPS in 2020 will come from high-cost projects that industry has not yet committed to, projects that are not competitive with more profitable opportunities elsewhere, because of high taxes here.

Because the progressivity formula hikes the tax as oil prices increase, the State captures 80 percent or more of the gains from the higher prices. The total government take on North Slope producers is approximately 72 percent at $110 oil. In the Lower 48, it’s much less.

In a recent earnings report, ConocoPhillips noted it pays twice as much in taxes in Alaska as it keeps.

The governor emphasized that investors take their money where they get a greater return. “The repeal of the progressive tax rate structure encourages the type of long-term planning and investment needed to promote new investment in new production in Alaska,” Parnell said. “Encouraging new production by lowering tax rates and simplifying the current system will promote growth in the economy and provide a more stable and long-term revenue stream for the State.”

Kara Moriarty, Executive Director of the Alaska Oil and Gas Association (AOGA), was encouraged with the bill’s initial direction and said it represents “a cornerstone for significant and crucial tax reform.” She said the bill “takes some positive steps toward the goal of more production, such as the 20 percent gross revenue exclusion concept for new oil and eliminating progressivity, which has led to Alaska being noncompetitive.”

However, Moriarty said there are some other provisions that need further consideration in order to fully achieve the goals set out in the legislation. Specifically, she expressed concern with what the bill proposes for tax credits – most importantly the repeal of credits for qualified capital expenditures. She said the gross revenue exclusion and tax credit restructuring proposed in the bill should be expanded and better tailored to fit the majority of projects for “legacy” fields to offset high costs and boost production from them.

“As we continue to evaluate the bill, we are committed to working with the governor and the Legislature in building a long-term policy for Alaska,” Moriarty said. “The members of AOGA desire the same outcome that the Governor and the people of Alaska want – more oil in the pipeline providing a solid future for our industry and continued revenues for the benefit of all Alaskans.”

Moriarty pointed out that “it will take a monumental effort to replace oil from declining fields with a mixture of new production and new stimulation to legacy fields, and bring the decline to a stop.”

At current oil price forecasts, Parnell’s legislation would initially reduce State revenue. However, if the measure boosts oil production as intended, revenues would increase over time and private sector business activity, including jobs, would grow, leading to a stronger economy in the long term. Moreover, production would boost royalty income to the State, of which at a minimum 25 percent is deposited into the Permanent Fund.

RDC is encouraging its members to comment on the need for oil production tax reform this session. Please visit akrdc.org for updates on the legislation and upcoming public hearings.

Return to newsletter headlines