Future progress on a massive natural gas pipeline and liquefied natural gas project in Alaska is highly dependent on significant reform of the state’s oil production tax, all three North Slope producers said at the Resource Development Council’s Alaska Resources Conference in Anchorage November 14.

“To support such a capital intensive project, it is essential that it is built upon a stable and competitive fiscal regime for both oil and gas,” said Randy Broiles, Vice President – Americas, ExxonMobil Production Company. “The development of a world class LNG project in Alaska faces real competitive alternatives in terms of both capital allocation and securing customers,” Broiles added. “Alaska will need to ‘compete’ globally to secure this opportunity.”

Gas and oil production tax issues are linked because the two are produced from the same wells and supported by the same infrastructure, explained John Minge, President of BP Exploration (Alaska) Inc. “We are serious about gas to LNG, but fiscal reform for oil and gas is essential to enable this massive investment to happen,” Minge said. “If the State has a short-term 10 to 15 year future mindset, ACES is the right approach. But if you want to take a long-term view and have a sustainable oil business and have a real shot at gas, change is needed. Within that view the legacy fields are essential.”

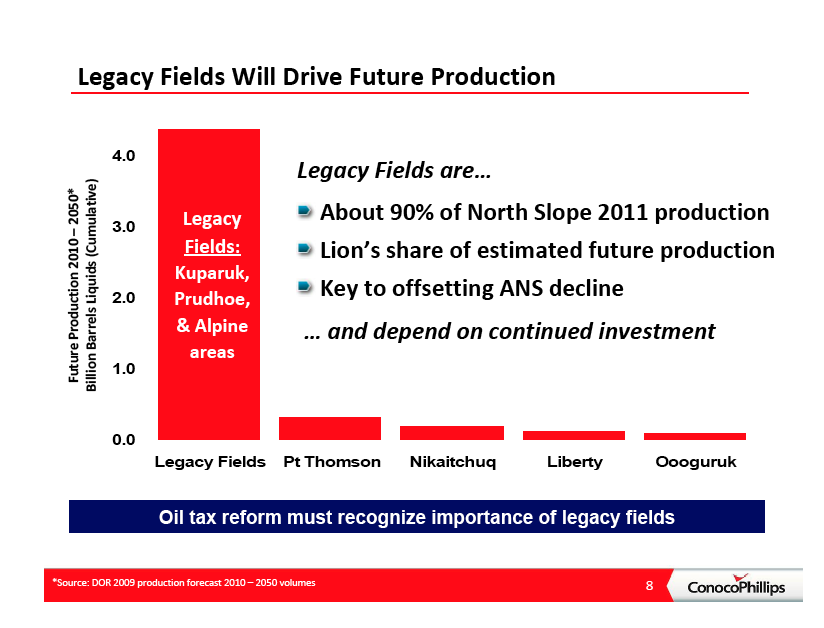

Nick Olds, Vice President for North Slope Operations and Development, ConocoPhillips Alaska, Inc., explained that North Slope gas production will depend on a healthy oil business with its related infrastructure. “Over the next four decades we see the potential for developing four billion barrels, but to produce those barrels, we will need to invest substantially in renewal of the infrastructure, and to maintain it so we will have a platform for gas,” Olds said.

BP’s Minge labeled the ACES tax structure as short-sighted policy. “ACES is clearly a short-term, going out-of-business policy, and it will deliver very predictable results. It is delivering very predictable short-term results and we have a five-year track record to prove it,” Minge said. “The State of Alaska is doing very well taking mass amounts of upside at today’s oil price. The long-term investment is down, especially capital going into production enhancement activities.”

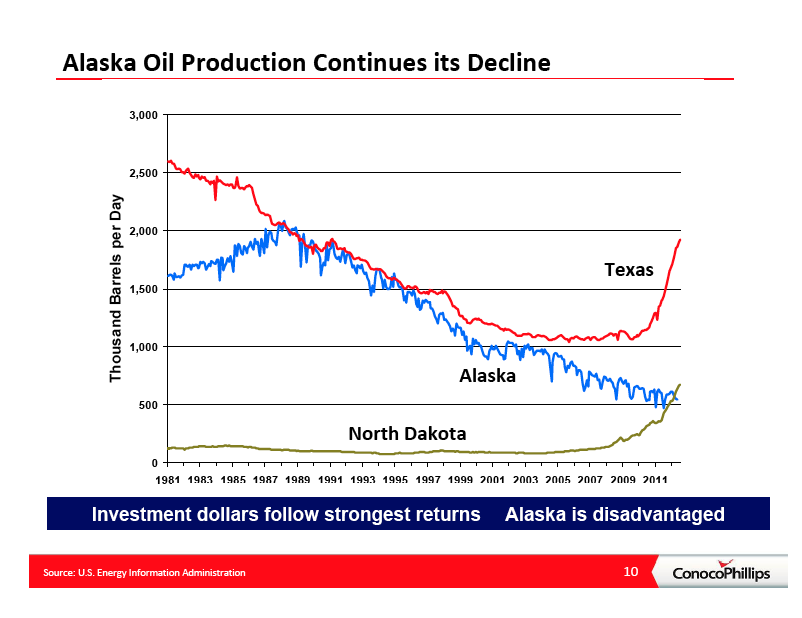

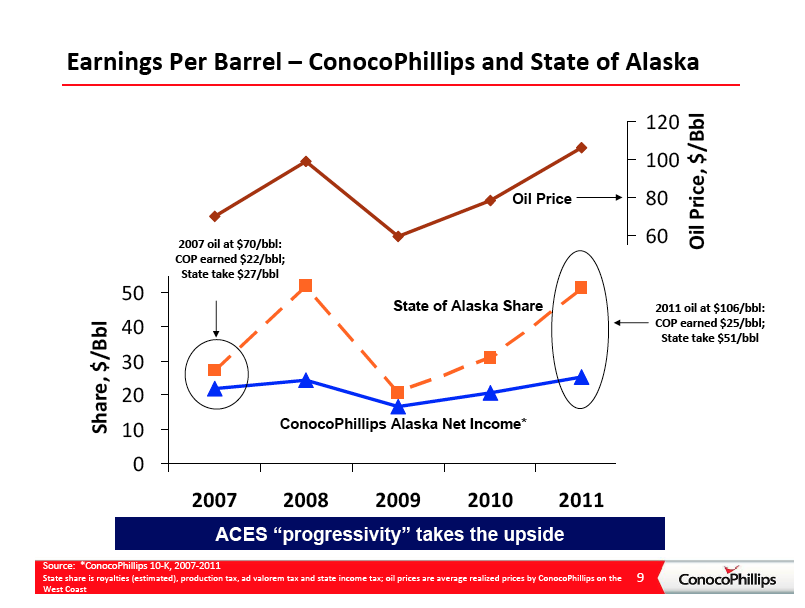

ConocoPhillips has increased its investment in Lower 48 projects from $1.6 billion in 2009 to $4.8 billion in 2012, mainly because of higher oil prices, Olds said. In contrast, ConocoPhillips’ annual investment in Alaska remained essentially flat at about $900 million over the same period. Olds said that was mainly because the State captured most of the gain of higher prices, leaving the industry with little incentive to increase production within Alaska.

For example, Olds said that in 2007 the State earned about $27 in net revenues per barrel when oil prices were at about $70 per barrel. ConocoPhillips earned about $22 per barrel. In 2011, oil prices increased to $106 per barrel with the State’s earnings rising to $51 per barrel, a gain of $23 per barrel. However, ConocoPhillips earned only $25 per barrel, a gain of only $3 per barrel.

If Alaska does not act to significantly reform its oil production tax, Minge warned oil production would continue to decline six to eight percent annually with TAPS throughput declining to 300,000 barrels per day within ten years. That level is considered the lowest economic operating threshold for the pipeline.

With tax reforms that move the needle on major investments, Alaska would get a healthy oil and gas industry that could extend decades, Minge said.

Addressing complaints that tax reform proposals have contained no guarantees that companies will actually invest and produce new oil, Minge said there are numerous examples around the world where governments have reduced taxes and industry has responded with new investment and increased production.

“I’m aware of no other place where people demanded guarantees,” Minge said.

Minge said Alaska policy makers hold the keys and the hammer, explaining the State can reform taxes to enable new investment but also holds the hammer to re-impose higher taxes if the industry does not respond. Minge said BP is having to adjust its plans to fit within the current tax structure.

“We probably should have done that two or three years ago, but we can no longer wait,” he said. “Today our plans have really been mismatched against the State’s policy. It was built on the hope that a change (in tax policy) would come. We’ve been focused on the more challenged resources and we need to take steps to invest in light oil. We’re going to stop our heavy oil investment into the heavy pilot project within a few months.”

“Alaskans are very aligned about what they want: a sustainable oil business, a major gas project to go forward, and everyone wants affordable energy for in-state needs and everyone wants jobs,” Minge added. “However, the current policy does not deliver that outcome.”

Broiles encouraged Alaskans to work together to secure new oil production and move forward on an Alaskan LNG project.

“Moving forward, together, we can integrate all of the diverse components that are required for a world scale LNG project,” Broiles said. “But we can only do this if producers, TransCanada, contractors, the State of Alaska, legislators, business leaders, and opinion leaders commit to the scale of the challenge in front of us.”

Broiles said the ongoing collaborative effort of the North Slope producers, TransCanada, and the State provides the best opportunity to develop the North Slope’s vast natural gas resources.

He said ongoing work covers the LNG value chain – from production and gas treatment, through an 800-mile pipeline, to liquefaction, and finally storage and loading facilities. “LNG isn’t going to be easy,” Broiles said. “Each of these components individually would be a world-class project, and in combination they represent a challenge that is almost impossible to visualize.”

The Alaska LNG project is estimated to cost between $45 billion and $65 billion. To put this cost in perspective, the Trans-Alaska Pipeline System, with 800 miles of pipeline, 11 pumping stations, and the marine terminal in Valdez, cost $8 billion in 1977.

“We can see that an Alaskan LNG project can be described as an unprecedented challenge, but the challenge is justified by the size of the prize,” Broiles said.

Making the project a reality would result in thousands of local jobs and new economic development across the state. The project could also provide decades of affordable energy for Alaskan homes and businesses, provide a boost to North Slope exploration and production, and result in new revenue streams for local and state governments.

Asian gas markets are currently consuming most of the world’s LNG capacity. Alaska is conveniently located in close proximity to these markets, which have expressed interest in Arctic gas. Broiles, however, warned that the window of opportunity may not remain open indefinitely as there are many new LNG sources of supply coming on stream, under development, or being planned.

“Like other industries, an Alaskan LNG project will need to compete with LNG projects in the Middle East, Africa, North America, and Australia,” Broiles noted. “Many of these have a head start. In Australia alone, there are at least six projects moving forward – all near Southeast Asian markets. All of which are further advanced than the Alaska project, and competing for the same customers.”

Broiles said Alaska’s current fiscal regime is not competitive on a global basis. He said that when tax regimes are favorable, investments follow. “A stable competitive fiscal regime drives investment, which will drive production, creating more jobs, growth and, of course, tax and royalty revenues. We believe the time has come to work together to develop a fiscal regime that enables the billions of dollars to be invested. The size of the prize for all parties demands that a mutually beneficial solution is reached.”

Broiles said there is a clear and compelling case for further collaboration to progress the project. He said that for the producers, it’s the ability to market gas to Asian markets and to provide a boost to North Slope oil exploration and production. For the State, it’s the opportunity to continue to receive and grow revenues, to offset those from declining oil production. And, for Alaskans, it’s the opportunity for economic development, additional jobs, and affordable domestic energy.

Tony Palmer, Vice President of Major Projects Development for TransCanada, said his company believes “Alaskans are ready to advance the project into the marketplace and compete.” Palmer said it will take the combined efforts of all the producers, TransCanada, and the State to move the project forward.

In a presentation leading up to the producers panel discussion, Kara Moriarty, the Executive Director of the Alaska Oil and Gas Association, noted Alaska has the highest industry costs and tax rates in the nation. She warned that corporate capital is limited, and only the most profitable projects in a company’s portfolio will get funded.

“Alaskans will get the maximum benefit over the long term by increasing oil production versus short-term gains through high tax rates today,” Moriarty said.

The State has collected over $160 billion from the oil and gas industry since 1959. Even with falling production, 90 percent of State revenues will continue to come from oil and gas, Moriarty said, noting the industry accounts for 44,800 jobs and $2.65 billion in annual payroll, not including State jobs or jobs related to capital budgets.

Return to newsletter headlines