We all know oil is the lifeblood of Alaska’s economy and funds nearly every state service.

We also know our North Slope oil production has declined precipitously to a level that threatens the viability of the Trans-Alaska Pipeline System (TAPS) - and with that, the personal security of every single Alaskan.

I think we all agree: stopping that decline is the most important challenge facing state policy makers today.

So the question becomes, why does production continue to decline and what can we do about it? There are several obvious reasons for production decline: anti-development activists, unreasonable federal mandates and interference, other oil province peers with more competitive economic terms than Alaska, and a maturing basin that requires an increasing level of labor and investment.

But most of all, we have an imbalanced fiscal policy that promotes exploration while penalizing development and production.

Of these factors, the one thing Alaska legislators can, and do, directly control is the tax policies that assure we get a fair share of our oil wealth while being sufficiently competitive. We must be sufficiently competitive to attract the private sector investment necessary to continue developing our resource and increase production. Alaska’s global competitiveness is the critical issue. We must maintain an economic environment that attracts instead of discourages investment. An environment that motivates our industry partners instead of penalizing them. The very foundation of the necessary economic environment is a tax system that is reasonable, globally competitive, stable, and balanced across the entire continuum of exploration, development, and future production activities. In recent years the legislature, in a wellintentioned but misguided eff ort to achieve these goals, has pretty much accomplished the opposite.

We have imposed the highest taxes in North America, at rates that are among the highest of our world-wide peer group. Taxes that are totally out of balance on the exploration/production continuum. Taxes that will remain unpredictable until we adopt reasonable reforms.

Opponents of tax reform point out Alaska’s producers are making money, and THAT should be good enough. But we have to remember how much more they can make elsewhere. It isn’t enough for Alaska to be profi table; we also have to be competitive.

Those opponents call tax reform a $2 billion dollar a year give-away.

What give-away? Wasn’t ACES supposed to improve our oil field economy, when in fact it has resulted in just the opposite? Why is it that in 2007, before ACES passed, the Department of Revenue projected more than 800,000 barrels a day production this year, and in fact, we are going to be lucky to get 600,000.

Many of us knew ACES was destined to fail when it passed. No government has ever successfully taxed any industry into productivity. We certainly tried with ACES, and it just isn’t working. We are collecting huge amounts of money today, but at the cost of our oil industry’s long-term viability.

Now here’s the amazing thing – if we can just increase production 10%, the Governor’s tax reform package is essentially revenue-neutral. That means no loss of state revenue. And if we simply bracket progressivity, it only takes a 4% increase to break even. With just a couple of responsible changes that improve the balance and fairness of our tax system, we can realistically expect to increase state revenues!

The courts have ruled that TAPS is not threatened by production decline. But, I don’t think Tom Barrett at Alyeska is a liar. He and his engineers know a whole lot more about TAPS than a bunch of liberal lawyers and their hired guns. We need to listen to what Mr. Barrett is really saying – it’s not that the pipeline will shut down, but rather, that we must be prepared for the extraordinary cost and effort it will take to keep TAPS operating if production continues to decline.

Those opponents say oil field employment is at historic highs, but how do they explain production decline? They are ignoring the testimony of real Alaskans who make their living in oilfield support industries. Those opponents are creating distractions, tying up legislative committee time with irrelevant debates on Alaska versus non-resident hire. We all want jobs for Alaskans, but who does the work has nothing to do with production decline.

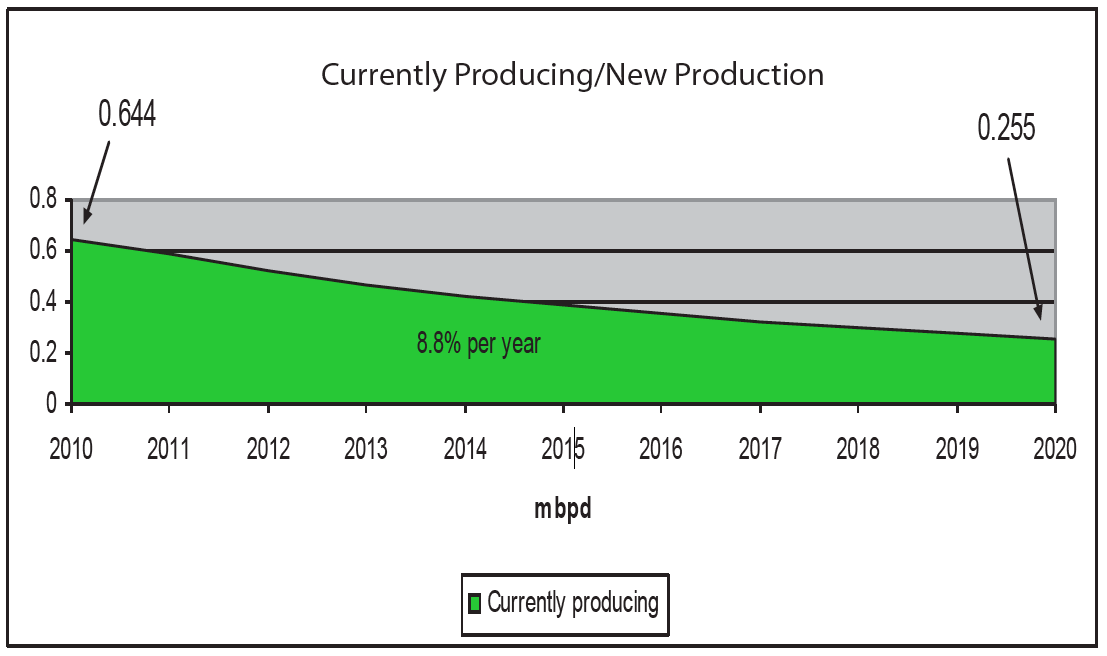

"Currently Producing" Decline

Without major new industry investment to bring on “new oil,” the state is forecasting oil production could fall under 255,000 barrels per day by 2020 – more than a 57 percent decline from today. Despite high oil prices, investment by major North Slope producers remains flat while it has more than doubled in the rest of the U.S. As a result, production has risen in the Lower 48 while it has declined at an accelerating pace in Alaska. Major producers are investing more elsewhere because they can capture more of the upside at high oil prices. Because of the progressivity effect in Alaska’s oil production tax structure, the state gets the lion’s share of the benefits as prices move higher, while industry earnings essentially remain flat.

Regardless of who is working, the high level of North Slope employment reflects an aging oil field that requires a lot of manpower for basic maintenance and operations. Those employees cost a lot of money, make the economics of our oil fields more difficult, and do not add a single barrel of production.

Those opponents say we are experiencing the biggest drilling season in decades, and all is good . . . Now here lies the entire problem and the answer to our tax policy question!

We have established an incredibly generous system of tax credits subsidizing exploration drilling and attracting aggressive venture capital companies, large and small. Some of those have never even drilled a well before.

The problem is – and all these companies have testified to this – they are here because we are paying them to be here, and our confiscatory level of taxes on future production challenges development of any discoveries made.

To be clear, the big legacy producers in Alaska are focused on development and production, not exploration. That is not a secret. It is not news. They’re spending hundreds of millions each year simply to get more oil out of existing fields and into our pipeline – and I, for one, am glad they’re doing it.

This is important. ACES was intended to punish those producers. To make them pay a “fair share.” Well, with the benefit of hindsight, we can now see that if we don’t re-evaluate what we consider a fair share, we will soon have nothing to share at all.

The massive exploration credits – or subsidies, call them what you will – in our tax system do not, and were not ever intended to, help the companies who actually produce our oil resources. Those credits were intended to draw newcomers to Alaska – smaller companies, venture capitalists. And they are working!

Make no mistake. I want these companies here. They’re the ones with plans, big and small, to drill and look for the future reservoirs that will help take the edge off the natural decline of our mature basins. But let’s not confuse the incentives that motivate these new explorers with a fair and competitive system for taxing the core legacy fields that provide nearly 90% of North Slope production and are the key to stemming decline.

That’s where we’ve gone wrong. ACES penalizes the very companies that produce the lion’s share of our oil, while giving generously to the newcomers who, in all likelihood, will turn to the big producers to help develop any finds they make.

With our current progressive tax structure, the state does get a lot more as prices increase. So much, in fact, that in today’s market we’ve taken nearly the entire financial upside away from producers deciding whether or not to invest in Alaska.

This is why we must – and yes, it is imperative – restore balance to our tax system, a fair balance of up-front exploration incentives and out-year taxes on development and production. And with this balance, we restore Alaska’s global economic competitiveness.

If the legislature listens and responds to the private sector businesses who know what they are doing and the economic policies we need, we can deliver more oil into TAPS.

Their single, very clear request is reasonable reform of our production taxes. Reform that makes Alaska competitive with our peers by restoring fairness and balance to our tax system. Reform that can realistically produce increased state revenues and longterm security for every adventurous soul who chooses to make the Alaska dream his own.

I will continue working with you to make Alaska a place where investment is not penalized and commerce can thrive again.

Return to newsletter headlines