The oil industry is the foundation of Alaska’s economy. North Slope oil production built the $39 billion Permanent Fund, accounts for at least a third of all jobs in the state, and provides 80 to 90 percent of Alaska’s unrestricted general fund revenues that pay for state government.

On the surface, the state’s current fiscal position appears strong, especially compared to the other 49 states. Alaska is only one of four states with a surplus. In addition to the $39 billion Permanent Fund, Alaska has over $11 billion in its savings accounts.

Yet not all is well. In fact, across Alaska’s private sector, there is growing concern – even outright alarm – about where the state’s economy is heading. Fiscal analysts warn those huge reserves and the high price of oil sweep a chronic oil production decline under the rug. That decline has accelerated and could usher in the premature shut down of the Trans-Alaska Pipeline System (TAPS), leading to a catastrophic drop in state revenues.

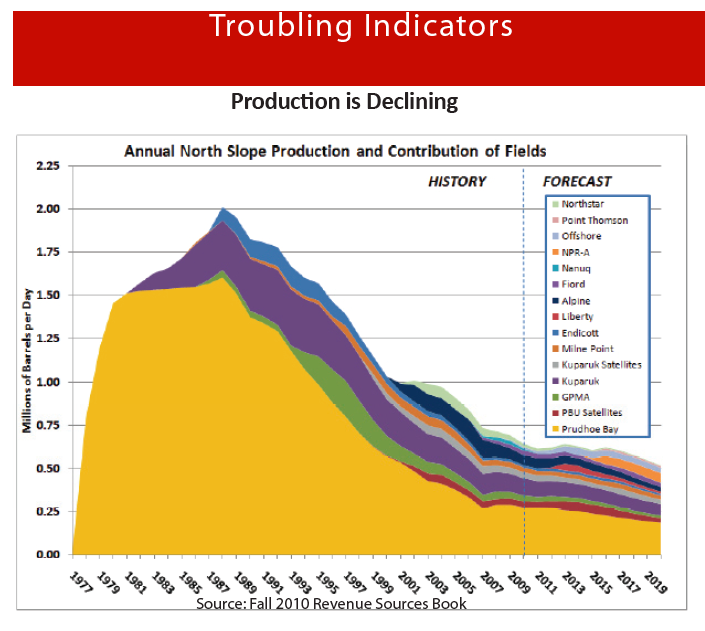

Higher oil taxes have kept state coffers overflowing, but oil production is declining faster than anticipated and there are no new fields on the horizon beyond Eni Petroleum’s 10,000 barrels per day (bpd) Nikaitchuq project which just came on line and BP’s Liberty field, expected in 2013.

In an effort to attract major industry investment back to Alaska to stimulate new exploration, promote infield drilling, and stem the production decline, RDC is encouraging legislators to pass Governor Sean Parnell’s HB 110, a bill that would make major revisions to the state’s oil tax structure. The debate on the governor’s bill is the biggest issue of the session. It has support from House leaders, but faces resistance in the Senate.

“Obviously, oil production is critical to our state’s future and provides the bulk of funding for our infrastructure, education system and vital services,” said Parnell. “Alaska must compete for jobs in the global context and we need to act this session to keep ourselves in the game.”

With investment leaving the state for other areas, Governor Parnell warned that Alaska is close to slipping from being the country’s second largest oil producing state to its fourth largest. “The more you tax, the less you get,” Parnell said. “The more we tax companies for producing a commodity, the less they will produce here, and the more they will produce elsewhere.”

With the highest energy taxes in the U.S. since the implementation of Alaska’s Clear and Equitable Share (ACES) in November 2007, Alaska trails most of North America as an attractive place to invest capital, according to the Fraser Institute’s annual study of 133 oil and gas jurisdictions worldwide. For North America, Alaska ranked 31 of 38 in overall attractiveness. Globally, Alaska ranked 68 of 133 overall. In the area of fiscal terms, a key element the state can control, Alaska ranked 34 of 38 in North America, and in a Wood MacKenzie study, Alaska’s fiscal terms ranked 117 of 129 globally.

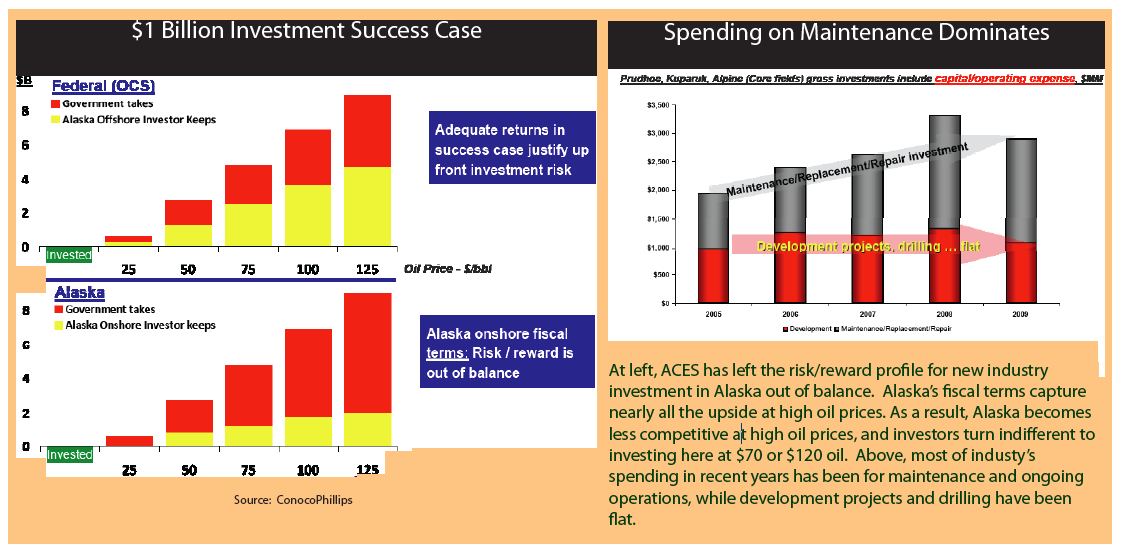

The current tax is onerous and a disincentive to invest here, investors warn, especially when oil prices are high, given the progressive surcharge which captures nearly all the upside. For example, at $100 a barrel, the government takes 71 percent of every dollar earned after operating costs. In Alberta, it’s 55 percent, in the Gulf of Mexico, it’s 43 percent. As a result, Alaska becomes less competitive at high oil prices, and investors turn indifferent to investing here at $70 or $120 oil.

Parnell’s bill sets a lower base tax rate for areas outside of current fields to encourage new development. It also caps production taxes at 50 percent and proposes tax credits for drilling wells.

The governor said there is no denying that lower tax rates could reduce revenue flowing into state coffers in the short term, but he said it is clear Alaska is competing in a global market and in the long term this reduction will make the state a more desirable place to invest. Parnell said his objective is to grow the economy and not necessarily the state’s savings accounts. “With the energy industry providing over 85 percent of our annual budget, cutting taxes will not just create jobs but, by increasing exploration and investment, will lead to greater revenue. That means money for schools, troopers, roads, and ferries,” Parnell said.

Industry executives say Parnell’s bill is a positive step toward encouraging the investment needed to boost oil production. They warned that increased investment is flowing into other states and countries with more favorable tax regimes.

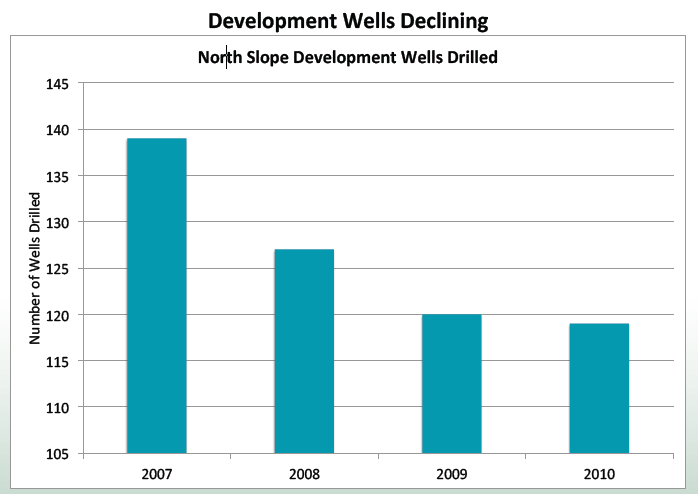

As the debate on the issue heats up in Juneau, the industry is citing new data on declining production, exploration, and well activity on the North Slope. In a presentation to RDC February 3 in Anchorage, Marilyn Crockett, Executive Director of the Alaska Oil and Gas Association, pointed out that only 119 development wells were drilled on the North Slope in 2010, compared to 142 in 2005. Development drilling is critical to sustaining production from existing fields.

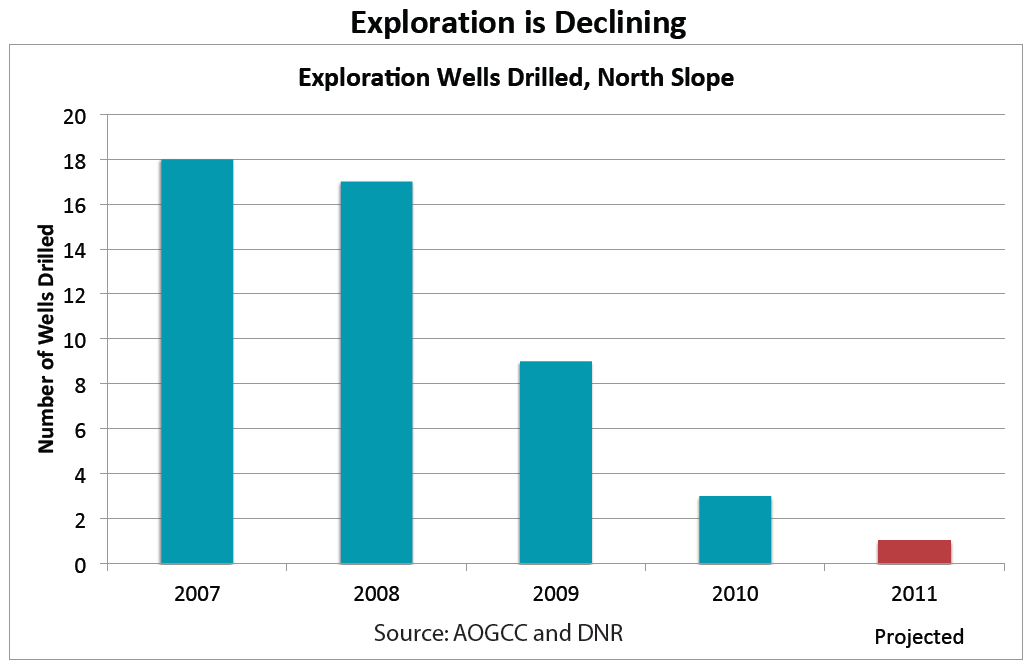

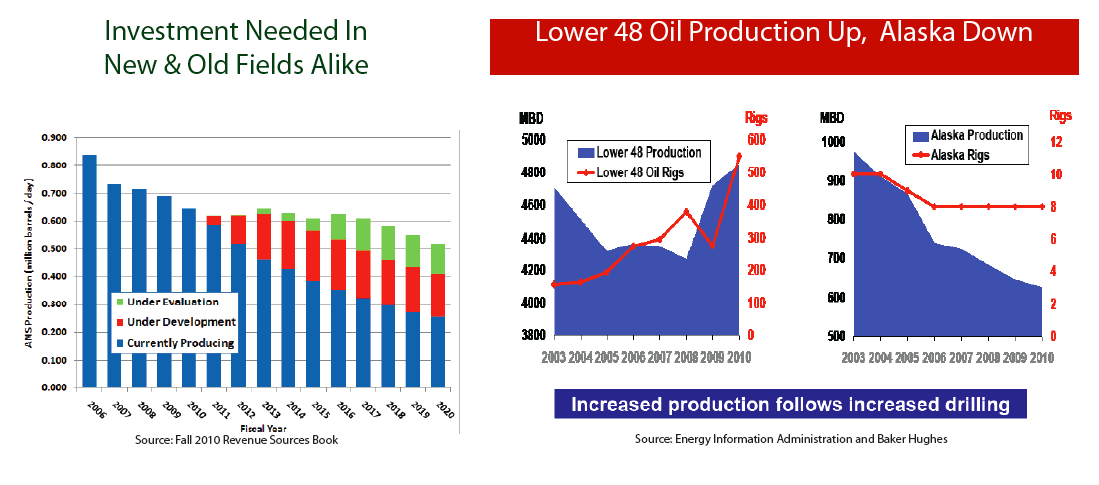

Crockett also noted exploration activity has fallen sharply. According to the Alaska Department of Revenue, only three exploration wells were drilled on the North Slope in 2010, compared to 18 in 2007. Crockett noted of the three wells drilled in 2010, two were delineation wells within existing discoveries. As a result, there was only one true exploration well drilled in 2010 aimed at finding new oil, she said. Despite high oil prices, only one exploration well is anticipated for 2011 on the North Slope while nearly 170 drill rigs are active in North Dakota. ConocoPhillips, Alaska’s most prolific explorer, did not drill an exploration well last year for the first time in 45 years and does not plan to drill this year.

Crockett warned the production decline on the North Slope is accelerating and reached seven percent over the last year. In Fiscal Year 2008, production fell 18,000 bpd over 2007; in 2009 the decline increased to 24,000 bpd, and in 2010 the decline accelerated to 48,000 bpd.

Crockett pointed out that it takes five to seven years to bring even a modest-size North Slope field on line, and with no fields in the lineup after Nikaitchuq, Liberty and the ConocoPhillips CD-5 project, which has been delayed by federal permitting issues, the state will ultimately face formidable challenges later in this decade in sustaining TAPS, Alaska’s economic lifeline.

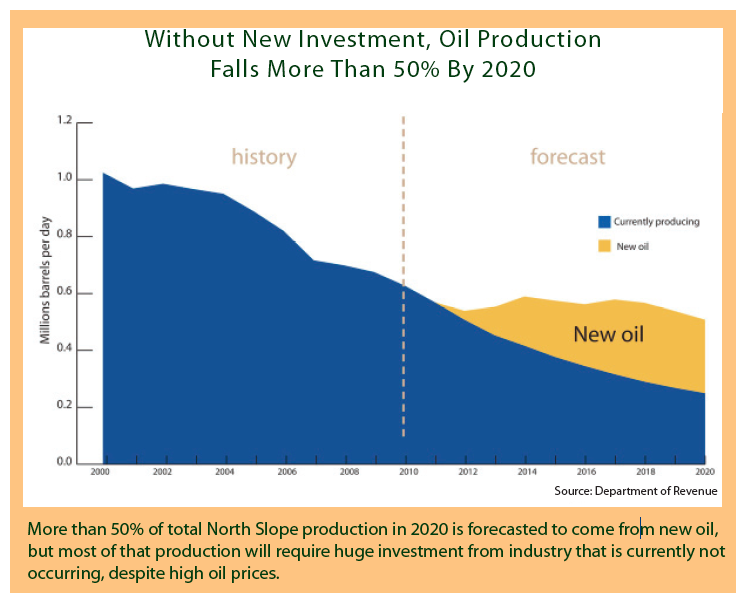

The state is projecting that more than 50 percent of total production in 2020 will come from new oil, but most of that production will require significant investment from industry that is currently not occurring.

Depending on the level of industry investment going forward, the state is forecasting oil production will fall to a range of 386,000 to 680,000 bpd in 2015 and 255,000 to 520,000 bpd in 2020.

“It is imperative the Legislature pass meaningful changes this year to the petroleum tax structure,” Crockett said. “The sooner the legislature acts, the earlier a recovery will take place in exploration and development activity.”

RDC President Tom Maloney warned Alaska simply can’t afford for the Legislature to do nothing in this session on oil production taxes. “Alaska is no longer competitive and it cannot prosper with a tax regime that hinders growth,” Maloney said. “Alaskans are very concerned about the decline in production and they see taxes as too high to encourage new exploration or development in existing core fields. We must take a leap of faith now to make Alaska a compelling place for industry to invest.”

Maloney emphasized there is an urgent need to slow the decline in TAPS, citing the 2010 decline of 48,000 barrels per day, which was much steeper than the state had anticipated in earlier forecasts. “The accelerated decline in throughput will turn into a terminal illness for Alaska’s economy without the right medicine,” Maloney said. He noted the pipeline is now running at twothirds empty and could become uneconomic to operate within ten years.

Maloney warned that a premature shut down of TAPS would not only devastate Alaska’s economy, it would also strand billions of dollars in state royalty payments, which exceeded $2 billion in 2010 alone and $46 billion over the past 50 years. “If we leave two billion barrels of oil on state land stranded, Alaska loses $22.5 billion in royalties at $90 oil. When other revenue flows are considered, Alaska could lose $90 billion in lost royalties and taxes. Without production, the state gets no royalties.”

Critics of the governor’s bill claim investment in the form of capital expenditures has increased since the implementation of ACES in November 2007. However, industry executives note that most of those capital expenditures went for maintenance and repairs, not projects that put new oil into the pipeline.

“There is no denying Alaskan exploration and development activity is down while other mature energy basins in the U.S. have mitigated their decline,” said RDC Executive Director Jason Brune. He noted investment, exploration and development activity in North Dakota is booming and the state is on track to surpass Alaska production in several years. He also pointed out that the Lower 48 led the world in production growth in 2009, while Alaska production continued to slide.

“There are still billions of barrels of oil waiting to be developed on the North Slope and offshore,” Brune said. “Eni brought Nikaitchuq online in February and expects the field to produce for 30 years, peaking at 28,000 barrels per day. Alaska needs two to three fields like Nikaitchuq to come online each year just to stem the ongoing annual production decline of six to eight percent. Governor Parnell’s HB110 will help encourage more exploration so more fields like Nikaitchuq are in Alaska’s future.”

Marc Langland, Chairman and CEO of Northrim Bank and a founding member of the Make Alaska Competitive Coalition, noted, “Alaska used to be the top oil producer in the nation and now we’re number two, and soon will drop to fourth as investment dollars are bypassing Alaska for North Dakota, Alberta, Australia, and Russia.” Langland added, “We don’t have a lack of oil in Alaska, we have a lack of investment. We must reverse the trend and get more oil in the pipeline. Alaska is simply not competitive under ACES.”

It is vital that RDC members contact their legislators in support of HB 110. See akrdc.org for a contact list of legislators, as well as member comments on HB 110.

Return to newsletter headlines