Alaska enacted a huge tax increase on the oil industry in November 2007 called Alaska’s Clear and Equitable Share (ACES). Although my professional background and certifications are in accounting and finance, there are tax provisions in ACES – including retroactivity and accelerating progressivity – that I have never heard of before.

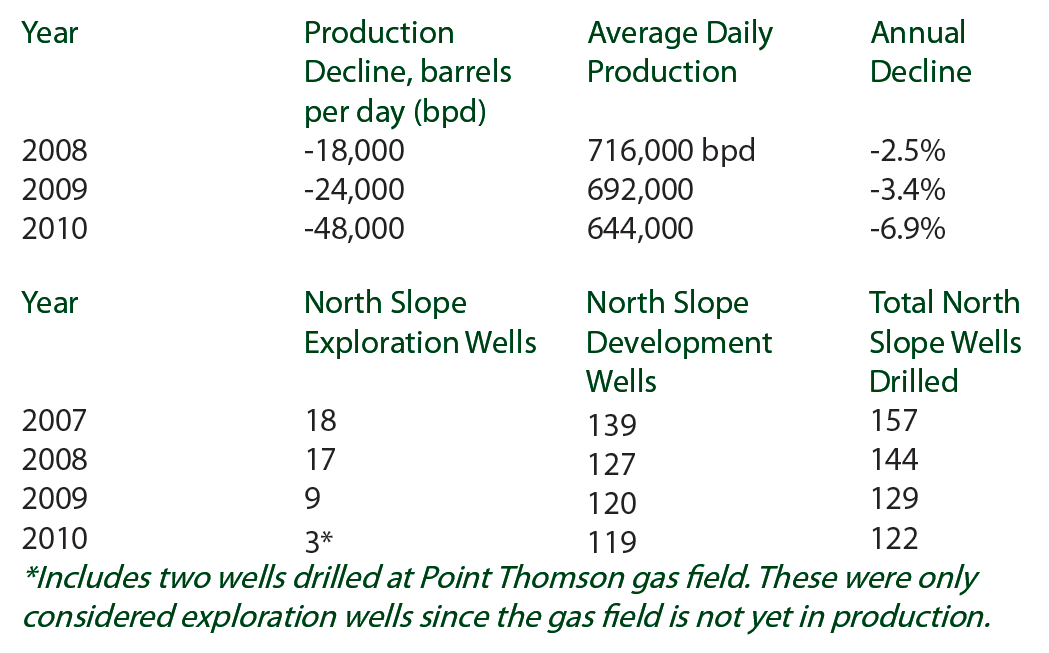

The multi-billion dollar tax hike increased production taxes by 50 percent from 2007 and 350 percent from 2006, based on an oil price of $80 a barrel, and even more at $90 oil. How is North Slope production responding to Alaska’s current fiscal regime?

Could you even begin to imagine this significant decline of your personal finances?

The next question: Why is production declining? The answer is simple. Drilling is down, and one cannot get to new oil, gas or water without drilling.

How does one stop the decline in drilling? There is only one answer and that is to DRILL! However, in my view, it is difficult to see how the punitive tax structure of ACES will encourage the oil industry to ramp up drilling in Alaska – when the government takes almost 80 cents of each additional dollar of profit earned at $90 oil.

Wall Street and other analysts have raised red flags about steadily declining oil production and its impact on the Trans-Alaska Pipeline System (TAPS), the lifeblood of Alaska’s economy. The recent temporary shut down of TAPS in January sent shock waves across the nation and gave Alaskans a preview of what the future may hold. A CNBC story used the shut down to highlight the impact of declining throughput on TAPS, Alaska, and the nation.

The challenges of restarting the pipeline in extreme cold at reduced flow clearly foreshadow the line’s future. Studies show that ice can form in the pipeline at a flow of 500,000 barrels a day or less, a threshold that may be breached within five years. While new investment in TAPS could help mitigate low-flow challenges, less oil in the line will hasten the day when the pipeline may be forced to shut down.

Analysts warn an accelerating TAPS throughput decline could lead to the premature shut-down of the pipeline, stranding billions of dollars in state royalty payments, which exceeded $2 billion in 2010 alone.

With a production decline of seven percent annually, TAPS could be non-functional before this decade ends. With no pipeline, Alaska would lose 90 percent of its revenue base and one-third of its private sector jobs. Considering a large portion of government jobs are supported by oil revenues, actual job losses statewide could be much higher. The ramifications to our economy would be absolutely devastating. How would the state pay for essential public services and honor long-term pension, medical, and other obligations?

The only way to keep the pipeline operating far enough into the future until potential offshore production kicks in sometime in the next decade is to encourage more development onshore. The only way to do that is to make Alaska a compelling place for industry to invest, and that is done by cutting taxes to sharply improve Alaska’s competitive position, which now ranks near the bottom of the pack on a national and global basis when it comes to fiscal terms.

Governor Parnell and some members of the legislature have proposed changing ACES to boost industry investment and create jobs. The governor clearly recognizes the current tax is onerous and a disincentive to invest here, especially when oil prices are high, given the high progressive surcharge.

Some legislators want to grow the state’s savings accounts as quickly as possible, convinced the production decline is irreversible. I respectfully disagree, believing the decline can be reversed. There is still a lot of oil to be produced from existing core fields on state lands on the North Slope. However, much of the remaining oil will be challenging and expensive to develop. Over the long-term, new offshore and ANWR production each have the potential to reverse the decline – if TAPS is still operating. Since 2003, the decline in production in Texas has been virtually arrested, demonstrating that mature energy regions can mitigate decline.

We need to do more than just grow the state’s savings accounts because it’s not about growing government, it’s about growing the private sector economy. A strong private sector will do more over the long term to sustain Alaska than a fat savings account, which will never replace the oil industry. The best way to grow the economy and create new jobs is to grow the pie, rather than government cutting a bigger piece for itself of a shrinking pie. More drilling will equal more jobs and production, which in turn will extend the life of TAPS and yield additional tax and royalty revenues to the state.

Critics of the governor’s plan claim capital expenditures, employment, and exploration are up since 2007. But investments primarily went up because of needed maintenance and repairs, as well as TAPS reconfiguration, Shell’s offshore activities, Point Thomson, and pre- ACES sanctioned exploration and development.

With regard to employment, the January 2011 issue of Alaska Economic Trends reported average monthly employment in the oil and gas industry fell to 11,800 jobs in 2010, a loss of 1,000 over the 2009 monthly average. This represented a 7.8 percent decline, the largest drop in employment of any sector. To compound the problem, these jobs were some of the highest paying in the state. Alaska Economic Trends pointed out that industry employment leveled off in 2009 and has been drifting downward, and this decline will likely continue in 2011. It said “the outlook for the oil patch in 2011 is unclear, though it appears maintenance such as replacing pipe and old infrastructure will dominate.”

Clearly, there are red flags everywhere. Consider these troubling indicators:

- Lower 48 oil production and drilling rigs have increased during recent years of high oil prices, but the number of Alaska rigs stayed about the same while production declined 36% since 2003.

- Beyond Nikaitchuq and the federal Liberty project, there are no new fields coming online in the foreseeable future to offset declining production.

- Alaska forecasts production will fall to a range of 386,000 to 680,000 bpd in 2015 and 255,000 to 520,000 bpd in 2020, depending on industry investment.

- By 2020, more than 50% of total production forecasted by the State of Alaska will come from new oil, which will require significant new investment that has not yet been committed.

- Using the historical decline trend of 7% for North Slope production, TAPS will reach a critically-low flow range by 2015, triggering operational issues.

- Acreage under lease on the North Slope has been in steady decline in recent years with the industry surrendering 1.8 million acres in 2008, 2 million acres in 2009, and 1.5 million acres in 2010.

- In North Dakota exploration is booming and oil production is up 138% since 2008. The state is expected to surpass Alaska in production later this decade.

Investors are warning us Alaska is no longer competitive. Alaska has to compete with Lower 48 opportunities, yet we have the highest energy taxes in the nation, as well as the highest capital costs.

If declining production in Alaska continues to accelerate and the state loses most, if not all, of its revenue flow from oil before this decade is out, it would have no choice but to turn to Alaska’s other industries to help pay the bills. Alaskans would likely face a new state income and sales tax and much higher user fees. The state would also be forced to raid the Permanent Fund, and spend its savings accounts to meet its obligations.

We simply cannot afford to do nothing. Alaska cannot prosper with a tax regime that strangles growth. We must take a leap of faith to make Alaska a compelling place for industry to invest. It is imperative our lawmakers act now. If they do, the governor’s bill, which if enacted, will move the needle and draw major investment back to our state.

Tom Maloney is a Certified Public Accountant, a Certified Management Accountant, and a Certified Financial Planner.

Return to newsletter headlines