North Slope producers delivered a sobering message to over 1,100 business and community leaders at the Resource Development Council’s 32nd Annual Conference on Alaska’s Resources in Anchorage last month.

Claire Fitzpatrick, BP’s Chief Financial Officer for Alaska, said her company expects up to an eight percent decline in North Slope oil production in 2012 and she warned that throughput in the Trans-Alaska Pipeline System (TAPS) could fall to about 550,000 barrels-per-day this winter.

Fitzpatrick said that a year ago BP committed to investing $800 million in Alaska in 2011, and she expects the company will invest $700 million in 2012. She displayed two slides, one representing planned activities on the North Slope over the next couple of years – activities like drilling, well workovers, pipeline maintenance and replacement, and upgrades. She said those activities will not begin to offset the eight percent decline in the fields BP operates, which currently account for two-thirds of North Slope production.

The other slide outlined possibilities - prospects that represent billions of dollars in new investment, billions of barrels of new oil, billions of dollars of new revenues for the state and the Permanent Fund, and thousands of long-term, well-paying jobs.

However, Fitzpatrick said the prospects outlined on the latter slide “do not make economic sense in the current business climate in Alaska – prospects that will remain only possibilities unless Alaskans and the oil industry work together to make changes that will make these possibilities commercially viable and competitive.”

Fitzpatrick acknowledged BP is making significant investments in infrastructure and pipeline upgrades, but capital spending on many activities that produce more oil is on hold or significantly limited. She warned that if the economics in Alaska do not improve, these activities will remain on hold.

“Our spending on these activities has not increased over the past few years, and production has dropped by more than 140,000 barrels of oil a day since ACES (Alaska’s Clear and Equitable Share) was passed,” Fitzpatrick said.

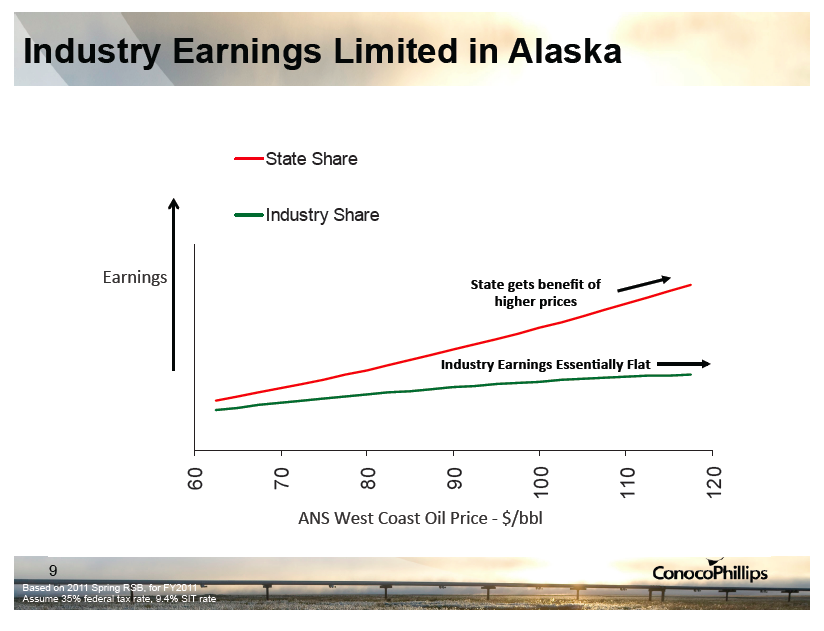

So with high oil prices and activity booming in other oil-producing regions, why is Alaska standing still? Fitzpatrick answered that in Alaska’s current high-tax environment, new projects can’t compete for investment capital and current activities do not generate enough cash to pay for them. She explained that investment goes where it has the opportunity to make the best return, and Alaska is falling behind.

“Because of the way ACES works, nearly all price upside is consumed by higher taxes, and the share for investors becomes relatively small,” Fitzpatrick said.

In the summer of 2007 – before ACES passed – BP planned to invest about $1.2 billion on the North Slope in both 2011 and 2012, Fitzpatrick said. She said the company is actually investing 40 percent less than what it had planned prior to ACES.

Current North Slope production has fallen to less than 600,000 barrels of oil per day – about 30 percent what it was at the peak in 1988. “That, combined with ongoing production decline, is a reality that can’t be disputed,” Fitzpatrick said.

The BP executive expressed concern with the state’s Department of Revenue (DOR) Spring forecast that predicted a 13 percent decline in statewide production between 2011 and 2020. She emphasized that DOR was clear to point out that 52 percent of the forecast volumes for 2020 was from projects under development or evaluation, including those in currently producing fields. In other words, more than half the oil the state is banking on comes with a big “if.”

Moreover, a lot of the “under development” category has not yet received a final investment decision, Fitzpatrick noted. That means more than half of the production in just nine years – and therefore more than half of the state revenue stream – depends on investments yet to be made.

Fitzpatrick also warned that her company is forecasting a much steeper decline in production over this period than it was last year at this time. After reviewing plans and activities in terms of what’s possible and what’s realistic in the current business climate, Fitzpatrick said BP is looking at a potential 25 percent decline by 2020 in the fields where it holds an interest.

“Put together, I see a 25 percent decline, with 50 percent of the state’s forecast production dependent on ‘if’ investment,” Fitzpatrick said. “So, without new projects, 25-50 percent of production will be gone in the next decade, and with it, 25-50 percent of the current work for contractors and suppliers in the state.”

She warned that TAPS throughput continues to tumble toward a critical threshold of 550,000 barrels a day, where a recent Alyeska study says the threat of freezing during winter increases significantly. At the rate throughput is falling, TAPS could reach that threshold this winter.

“BP and our partners are poised to invest billions of dollars in new projects that will result in billions of barrels of new oil from known sources that will sustain throughput in the pipe, and generate billions of dollars in long-term state revenue – when there’s a competitive business climate,” Fitzpatrick said. “These projects can be competitive if Alaska decides that it wants to compete.”

Fitzpatrick said BP will produce as much oil as economic conditions allow. “Make the economics less favorable, as ACES has done, and investment suffers. Improve the economics, as the governor’s House Bill 110 would do, and we’ll respond accordingly with investment in oil production.”

She urged conference attendees to be actively engaged with the state’s decision makers and urge them to adopt fiscal and regulatory policies that will promote more investment, more jobs, and more production. She noted that a recent poll has showed nearly 60 percent of Alaskans now believe oil taxes should be changed in order to compete for oil industry investment.

Alaska’s current oil production tax is the biggest impediment in getting more oil into TAPS and the biggest obstacle to oil company investment in the state, said Trond-Erik Johansen, president of ConocoPhillips Alaska, Inc.

Johansen concurred with Fitzpatrick in that while high oil prices make investment in other oil jurisdictions attractive, his company is not planning additional investments in Alaska in 2012 because of the state’s tax climate. He expects the company’s budget to be flat, about the same as the previous two years, while it has increased more than 100 percent in the Lower 48.

As a result, oil production in the Lower 48 has increased sharply and Alaska, which use to be the top producer in the U.S., has fallen to number three and could soon fall to fifth or sixth place.

Johansen said oil production is declining in Alaska because the “easy oil” has been drilled and ACES takes away the incentive for companies to invest at high prices.

Johansen explained that drilling costs have spiked while at the same time North Slope wells are producing less. “My point is we need to drill more wells. We need to have more people working on more wells. That also means it needs to make commercial sense to us,” Johansen said.

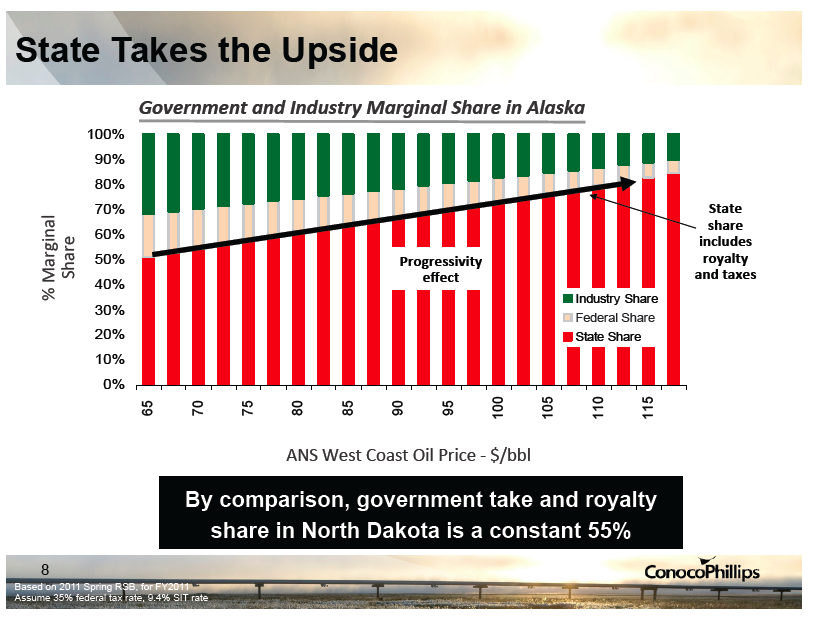

With the progressivity factor in ACES, the higher the price of oil, the less incentive there is to drill for challenged oil, Johansen said, compared to other places where taxes and royalties are flat, allowing a company to capture more of the upside at high prices.

Johansen noted that in North Dakota taxes and royalties are 55 percent, compared to 85 percent in Alaska. He said other places in the world also have higher taxes, but when the price of oil climbs, taxes and earnings rise together.

“We take the risk; we want a fair share of that reward for taking that risk and that’s not happening” in Alaska, Johansen said.

Johansen said the question is when will Alaska benefit.

With lower taxes, in the short-term, the state would see less revenue, Johansen acknowledged. But in the long term, with improvements in the fiscal regime, “you will see more drilling, you will see more projects...that is just the way capitalism works,” he said. The question is whether the discussion will be “around short-term gains or are we going to talk about the long-term future,” he said.

Johansen noted that last spring his company committed to increase its investment in Alaska should the legislature enact substantial fiscal reforms. With fiscal reform, Johansen said ConocoPhillips will increase drilling activity, pursue more satellite developments, and pursue major projects in existing fields.

He said Alaskans have a choice of two possible futures – no fiscal reform, which will lead to an acceleration in production decline and jobs and investments going to the Lower 48 and abroad, or a future with fiscal reforms, which he said would bring increased production drilling and capital, an arrest to the production decline, more jobs and investment in Alaska, and a strong long-term state economy.

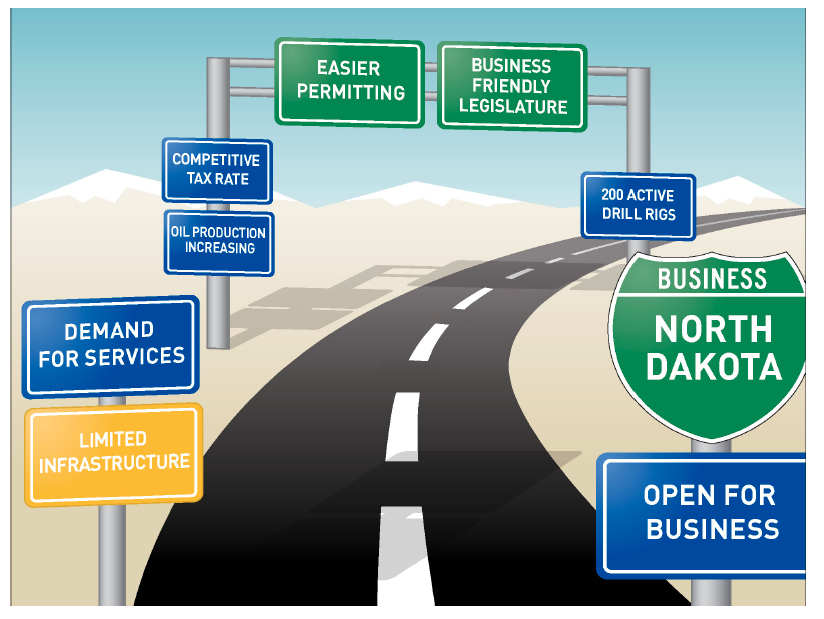

Doug Smith, president of LRS Corporation and David Cruz, CEO of Cruz Companies, shared their concerns during a panel discussion called, “North Dakota or Bust.” Smith said he has not yet joined a number of Alaska contractors who are now operating in North Dakota, but feels he is now behind the eight ball. “If I stay in Alaska and continue to invest, you can see some of our challenges,” Smith said, while displaying several slides (pictured above) comparing the business climate and industry activity in Alaska to North Dakota. He noted there are approximately 200 rigs in North Dakota and only 17 in Alaska.

“The sign that should scare us the most is the increasing state budget,” Smith warned. “From 2006 to 2010, our budget went up 40 percent – from $6 billion to $10 billion (including federal matching funds). Over the same exact period of time, our production went down by 23 percent. I don’t know how you guys run your business, but if I ran mine that way, I know where I’m going to be in 28 years, that’s broke and out of a job,” Smith said.

Dave Cruz, CEO of Cruz Companies, said his diversified operations on the North Slope have seen a tremendous slow down over the past two years, forcing him and other service companies to focus on North Dakota, where industry investment is booming. He employed 200 people on the North Slope in 2008, but only 12 last winter.

“We have lots of positions open in North Dakota and none in Alaska,” Cruz said. “When I look out my office window, I see a steady stream of Alaskans coming in wanting to leave the state and go to work in North Dakota. I look at these young folks and they are leaving; they are not seeing a future in Alaska. They have sold their homes and are moving their families. What’s alarming is they don’t have to leave – we are paying to fly these guys back and forth. We’re losing senior workers and they are not coming back.”

Cruz revealed that over the last five years, not a single exploration well his company has worked on in Alaska has come into production. Yet in North Dakota, he said there is a 90 percent chance that a well will produce.

He noted that in December 2010, 130 rigs were working in North Dakota, rising to 199 today. In Western Canada the rig count is 479.

“They are on the rebound from changing their tax structure that crippled their industry three years ago,” Cruz said of Western Canada. “They’re drilling 12,600 wells.”

Cruz noted in 1974 the largest private sector employer in Alaska was the Southeast Alaska timber industry. “Multiple sawmills, two thriving pulp mills, and thousands of well-paying jobs were legislated out of business,” Cruz said. “The market did not shut them down, legislation shut them down. Regardless whether it was federal or state, it was politicians that did it. Is this the history we’re going to write for the oil industry in Alaska? We might see history repeat itself.”

North Dakota is drawing companies out of Alaska because it extended a friendly hand to the oil industry and businesses that support it, Cruz said. The state enacted lower royalty rates and tax incentives to encourage investment, he said.

“In Alaska, the progressivity measure in the state’s oil production tax system is strangling our industry and funneling opportunities to North Dakota,” Cruz added. “We have major problems. We’re not competitive in Alaska. We do not have a favorable business environment.”

Cruz credited Governor Parnell for recognizing the threat high oil taxes pose to the state’s economy and he praised the governor for his efforts in trying to roll them back, but warned, “a click of Alaska state senators are playing Russian Roulette with Alaska’s future.”

The Alaska contractor also took a shot at the federal government. “Federal regulators with the Fish and Wildlife Service, the EPA, the Corps of Engineers, and the BLM – armed with endless mazes of bureaucracy and paperwork – are eroding the incentive for companies to explore and develop in Alaska,” Cruz said to a hearty applause.

Return to newsletter headlines