Many Alaskans know that oil production accounts for roughly 90 percent of state revenues. It is great that Alaskans do not have to pay a state income or statewide sales tax due to our oil wealth.

Representative Mike Hawker wrote in the last Resource Review, “We all know oil is the lifeblood of Alaska’s economy and funds nearly every state service. We also know our North Slope oil production has declined precipitously to a level that threatens the viability of the Trans Alaska Pipeline and with that the personal security of every single Alaskan. I think we all agree; stopping that decline is the most important challenge facing state policy makers today.”

I strongly agree with Mr. Hawker.

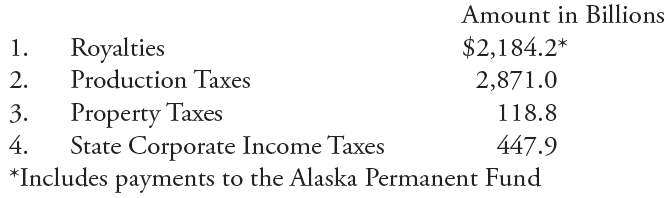

Most Alaskans are not aware of the complexities of their own tax returns, no less the oil companies. However, there are three primary state and local taxes that oil producers pay, as well as royalty payments, which are as follows for FY2010.

The federal government also takes its share.

The ACES tax which came into place in 2007 under then Governor Palin dramatically increased the production tax component. It did not affect the other tax elements. Production taxes can change over time through the legislative process.

Royalties

The State of Alaska leases land on a competitive basis to companies for the purpose of oil and gas

exploration, development, and production. As the land owner, the state earns revenues, or its share, in three ways.

1. Bonus bids at the time of the lease sale

2. Annual rent

3. Royalties during the production of the field

Royalties are not paid unless there is production. The state generally retains a royalty interest of at least 12.5 percent. Most current production is from leases that carry this royalty rate.

Royalty percentages are set for a long period of time. Prudhoe Bay, the largest oil field in North America, has been paying the state billions of dollars in royalties at the 12.5 percent rate since 1977.

The state forecasts oil production and oil price for future periods to assist in budget preparation. In 2007, prior to ACES having been passed, the Department of Revenue forecasted Alaska oil production would exceed 800,000 barrels per day in 2011. Our actual results for calendar year 2011 through October were approximately 574,000 barrels per day. Just think, our royalties would be around 38 percent higher if production had been 800,000-plus per day.

Alaskans have been trumped by ACES. Production has declined at a faster rate every year since this confiscatory tax went into effect. This year is the worse yet with a decline of 70,000 barrels per day. You do not have to be an accountant to figure out that the needle is moving toward empty at an accelerating pace.

Governor Parnell has a lofty goal of increasing production to one million barrels a day in the next ten years. It can happen with multi-billion dollar investments by oil companies. It will require a significant increase in drilling, new and modified infrastructure, and a cooperative attitude by multiple parties.

All Alaskans, or almost all, enjoy receiving their Permanent Fund checks every year. The Alaska Constitution requires that 25 percent of all royalties be deposited into the Alaska Permanent Fund. Our future individual check size will be greatly enhanced with more oil production. Remember, no production equals no royalty.

Alaskans depend on good-paying jobs and the state government is reliant on oil production to pay its bills. If the accelerating decline in oil production is not arrested, TAPS could face premature shut down. If or when that happens, the tax burden to keep Alaska running will fall on you and me.

Let’s get Alaska moving again. We want to maximize royalties for the benefit of all Alaskans. There is a need to drill to pay the bill. We have no dough without oil flow. We have a lot of oil left on the North Slope. Let’s safely develop it to create long-term royalties and employment opportunities for Alaskans.

Return to newsletter headlines