The most important issue before the legislature this session may well be evaluating Alaska’s oil production taxes. Alaskans have widely differing positions on this issue grounded in their individual beliefs and values. I respect that. Alaskans also demand that legislators listen to all sides of the argument, get the facts straight and make the best decisions possible. We all must conduct this discussion with a commitment to seeking truth.

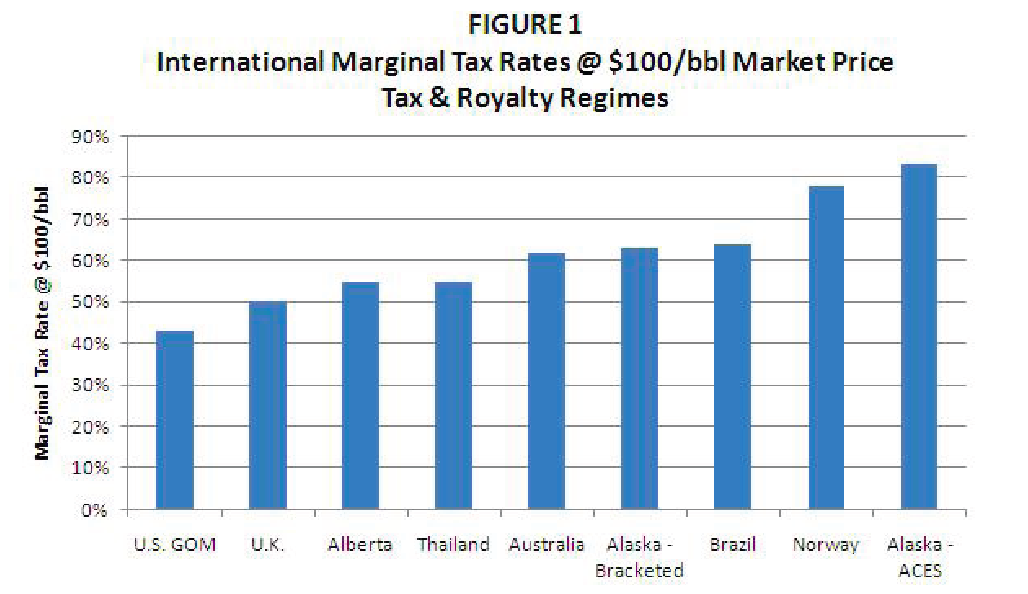

When ACES, the current production tax law, passed in 2007 it imposed one of the highest marginal tax rates in the world. Marginal taxes are the amount of the next dollar earned that is taken by government. Figure 1 shows the marginal tax rates at recent oil prices for major petroleum producing jurisdictions competing against Alaska.

When taxes were raised in 2007, much of the committed activity on the North Slope did not stop immediately. Work continued, high taxes were paid and Alaska took in a lot of money. However, we cannot impose one of highest taxes on earth without expecting an adverse reaction from taxpayers with other options – and we are seeing that now.

Alaska competes around the world for oil company investment. In this age of globalization, capital is fluid, but finite; capital goes to the best deal. We have to consider how Alaska investments stack up against other opportunities. It is not enough for Alaska to be profitable for investors; we also have to be competitive.

The producers have profi ted here under ACES. But the issue is not profit. The issue is how much more they can make somewhere else. Figure 1 shows they can make a lot more elsewhere.

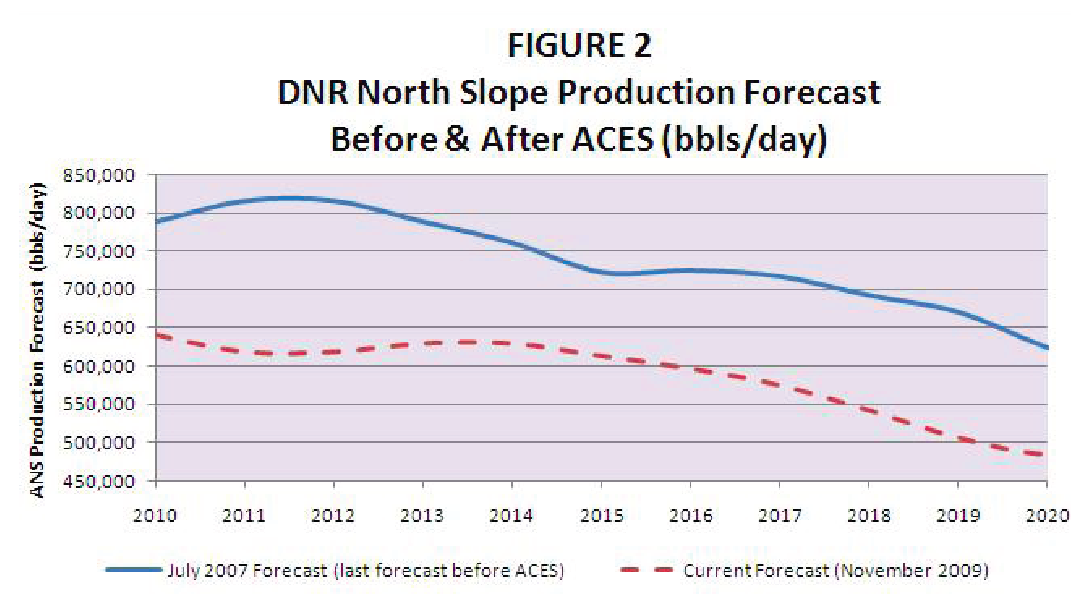

Figure 2 compares the Alaska Department of Natural Resources’ (DNR’s) last production forecast before ACES passed, and the most recent.

Just three years ago, DNR predicted 816,000 barrels per day production in 2011. Now the expectation is only 616,000. Th at is 200,000 barrels a day less! Between the two forecasts, 600 million total barrels have been lost for the years 2010 to 2020.

Nearly 90% of the North Slope oil production expected in future years will come from legacy fields like Prudhoe, Kuparuk and Alpine. Legacy field development is vital. However, because Alaska investments are not competitive with others around the world, critical projects have been deferred or cancelled. Current spending is for basic maintenance of existing facilities, not for the development of additional production – and we need those barrels to arrest the accelerating decline curve.

Unfortunately, only 3 exploration wells were drilled last year on the North Slope, the lowest number since 1988 when oil prices were $8 per barrel. Two of those were actually delineation wells at Pt. Thomson. The facts are clear. Exploration has all but ceased and production has been lost as a result of ACES. If Alaska does not change what we consider our fair share of the resource value, we will soon have nothing to share at all.

Alaska’s production tax system is heavily front-loaded with incentive credits for exploration. While that drives some spending by explorers, it isn’t returning significant increases in production. The problem is that high taxes in the out years of production outweigh the benefits of those initial incentives. We have a system that is out of balance, and clearly not working.

The simplest and most effective fix is adjusting the progressivity feature of our tax system to a more competitive level. Progressivity is the tax component that goes up with oil’s market price. Sensible adjustments to the progressivity configuration will restore balance to Alaska’s tax system allowing Alaska to reap the highest possible share of the resource value while still making needed new investment attractive to industry.

These changes will result in real improvements to Alaska’s economic prospects if we stick to the FACTS - that is, a Fair And Competitive Tax System. Just the FACTS.

Representative Mike Hawker, (R) – Anchorage, is Chairman of the Legislative Budget and Audit Committee.

Return to newsletter headlines