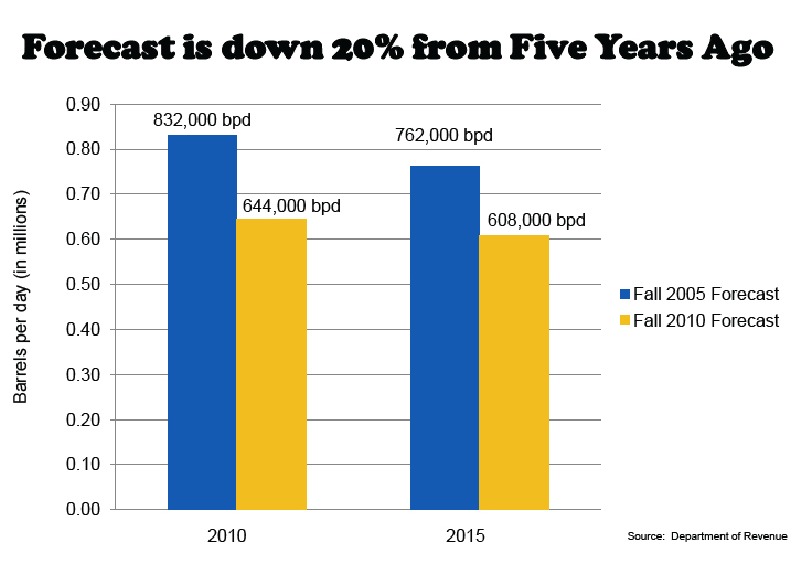

We all know that brilliant minds cannot accurately predict short and long term oil and natural gas prices, nor can they accurately predict oil production through TAPS. Just check out forecasts from five years ago.

In 2005, the State predicted TAPS production would average 832,000 barrels per day (bpd) in 2010. Actual production was 644,000, 22 percent less than forecasted. In 2005, the State forecasted 762,000 bpd in 2015. Yet current production is 630,000 and falling.

Oil production is declining faster than expected. Could it be Alaskans have been trumped by ACES?

Wayne Gretzky the Great One said, “You miss 100 percent of the shots that you don’t take.” The same is true with hydrocarbons. Without new investment, there is no drilling and without drilling Alaska gets no new production. Without new production, the only question is when will TAPS shut down?

Tax policy must change in a way that reflects the important role drilling has in Alaska’s economy. Investors take 100 percent of the risk to lease, explore, and develop a resource. At high prices, government can take more than 80 percent of the income stream of a barrel of oil. What is the incentive for an investor to take risk? Would anyone with their own real estate, stocks or other investments give the government almost all the upside while taking all the downside?

How much progress has Alaska made since ACES was enacted? The number of exploration wells drilled on the North Slope has fallen from 18 in 2007 to one this year. Development drilling is also down. Throughput in TAPS declined by 18,000 bpd in 2008, 24,000 bpd in 2009, and 48,000 bpd in 2010. The sharp decline has raised concerns that forecasts are too optimistic and inaccurate.

If production levels in 2010 were as forecasted, the gross value of the oil would have been approximately $5.5 billion more for the year. Is the accelerating production decline a sign of what is to come? Looking ahead, will Alaska strand billions of barrels of oil on the North Slope and billions of dollars in revenues because Alaskans were trumped by ACES and the premature shutdown of TAPS?

The trends are alarming. More than 50 percent of North Slope production in 2020 is forecasted to come from new oil, but most of that production will require new drilling from industry that is currently not occurring, despite high oil prices. Without major new investment, production could fall to 386,000 bpd by 2015 and 255,000 bpd in 2020.

CNBC’s Scott Cohn recently reported that low throughput could usher in the shutdown of TAPS. With no pipeline, Alaska would lose 90 percent of its revenue base.

Imagine Alaska without TAPS. How would the state pay for essential public services, fund education, and honor long-term obligations?

According to a new report by the University of Alaska’s Institute for Social and Economic Research (ISER), if there were no pipeline, Alaska’s economy and workforce would be half its current size. ISER noted the oil industry has huge “spinoff” effects benefitting virtually every household, community and business. It explained these spinoffs have helped non-oil sectors of the economy prosper and create about 60,000 more jobs than they otherwise could have. These jobs are in addition to the 127,000 jobs generated by oil production and state spending of its oil revenues. Together, they make up about half the jobs in Alaska. (See page 3 of this newsletter).

ISER emphasized Alaska needs new oil production and nothing else, including a North Slope natural gas pipeline, can replace oil in the state’s economy. Every Alaskan should ask their legislator if they are aware of this study. In fact, every Alaskan should read this study.

Some folks apparently believe Alaska can tax and save its way to prosperity, but big savings accounts cannot make up for the economic activity and revenues generated from oil. ISER made this clear. We need a strong private sector economy.

Alaska is the highest taxed oil region in North America. Higher taxes have dampened investment and will ultimately result in less revenue to the state. Critical investment dollars are being directed Outside to other projects that have much better rates of return at high oil prices.

To sustain the economy, Alaska needs to encourage new investment to get more oil into the pipeline. The best way to do that is to make Alaska a compelling place for industry to invest. We need to improve Alaska’s competitive position, which now ranks near the bottom in the area of fiscal terms.

There is still a lot of oil to be produced from North Slope core fields on state lands. However, much of the remaining oil will be challenging and expensive to develop. Over the long-term, new offshore production has the potential to reverse the decline – if TAPS is still operating.

Governor Parnell has a plan to get Alaska moving again. He clearly recognizes we simply cannot afford to do nothing. The governor’s plan will make Alaska a more compelling place for industry to invest, which in turn will result in higher production and revenues – something we can all support.

Return to newsletter headlines